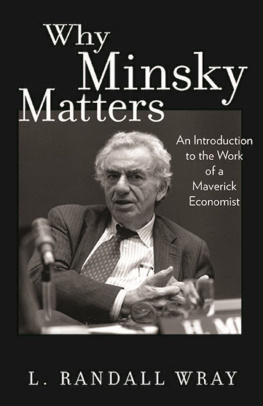

WHY MINSKY MATTERS

WHY MINSKY MATTERS

An Introduction to the Work of a Maverick Economist

L. Randall Wray

PRINCETON UNIVERSITY PRESS

Princeton and Oxford

Copyright 2016 by Princeton University Press

Published by Princeton University Press, 41 William Street,

Princeton, New Jersey 08540

In the United Kingdom: Princeton University Press, 6 Oxford Street,

Woodstock, Oxfordshire OX20 1TW

press.princeton.edu

Jacket photograph Beringer-Dratch.

Courtesy of the Levy Economics Institute of Bard College.

All Rights Reserved

ISBN 978-0-691-15912-6

Library of Congress Control Number 2015945043

British Library Cataloging-in-Publication Data is available

This book has been composed in Garamond Pro and Filosofia

Printed on acid-free paper.

Printed in the United States of America

1 3 5 7 9 10 8 6 4 2

CONTENTS

PREFACE

Minsky matters, and this book will explain why he should matter to you.

This is not a biography of Hyman P. Minsky. Nor is it really an exercise in the history of Minskys thought. Rather, I am trying to make Minskys ideas accessible to a wider audience. Minskys writing style is notoriously opaque. Even those who want to understand him, including trained economists, find his work difficult.

This book will explain Minskys most important contributions in jargon-free plain English. I explain why Minsky matters for those who might have heard the name Minsky in recent years and want to delve into the mans contributionsmuch as one might try to figure out why Charles Darwin matters, or Sigmund Freud, or Milton Friedman.

You probably already know of Friedman, and you might even have read some of his books. He wrote for a general audience in a simple but lively style. Minskys style is much more turgid, and he rarely targeted anything he wrote for a general audience. Even when he did, he usually missed. He needs to be translated.

But a straight translation is not sufficient if one is trying to hit a general audience. The writing must also draw the reader in; it must make the topic (Minsky) interesting. The angle that makes Minsky interesting right now, is that he saw the Global Financial Crisis coming. But this crisis will not be the last one, and he also saw the next one comingand the one after that.

Yet, this is not really a book about the crisis, although you will have a much better understanding of financial crisesand what to do about themafter reading this book. Minskys work enables one to understand our most recent crash but also to recognize the forces that will bring on the next one.

I organized the book around three main themes one finds in Minskys publications: the financial instability writings that led up to his now famous book Stabilizing an Unstable Economy; his early work on employment, inequality, and poverty; and his last work from the mid-1980s to his deaththat led to the Money Manager Capitalism analysis. Although all of these are linked, it was useful to treat them as phases of his career.

A theme running throughout his work is that the vision of most economists is wrong. Market processes are not stabilizing. Adding bells and whistles to accepted economic doctrine does not make up for the wrong vision. Minsky matters because his vision was different.

Minskythe manwas larger than life. He always wanted to be the center of attention, and he usually was. He was the smartest guy in the room, in every room. He was tall and gregarious, with a head full of wild hair. Even in old age he was impish; in pictures as a young man, he looked rakish with his cigarette.

I vividly remember the first time I laid eyes on him. Actually, I heard him first, as he was shuffling into the classroom while mumbling to himself: Too many students; every year there are more of them. Id really like the last one who enters the classroom to close the door because we dont want anyone out there to know whats going on in here. He then launched into the most incredible lecture that ranged from the Cross of Gold speech of William Jennings Bryan, through the Wizard of Ozs indictment of New York bankers, and on to the previous days St. Louis Cardinals baseball game, with all loose ends neatly tied by the end of class.

When I was his teaching assistant, he called me into his office to lecture me that you can be radical in your thoughts, but not in your dresstelling me I must always keep dress pants, a dress shirt, and a tie in my office as he frowned at my preferred dress of tank top, shorts, and flip-flops. As I found out years later, it was the same lecture Professor Lange had given him when he was a graduate student.

As his TA, I spent most of the time trying to convince him that he was far too generous in assigning grades to his under-grads. I suppose he felt guilty for his lecture style, which stumped at least half the class. He rarely came with notes, never followed a syllabus, and mostly avoided discussing assigned readings. Generosity was his restitution.

Minsky began many conversations with, You have to remember as he then discussed the minutiae of obscure events that occurred decades before you were born. He had developed his own language that required time and some effort to pierce. One does not buy an asset in Minsky-speak, rather one takes a position in an asset. When one has to sell assets to make payments on debts, this is selling position to make position. To some extent, this was because he wanted to be precise and had picked up terms from Wall Street, but I suspect that he enjoyed some mystery and notoriety for obscurantism.

Hed give a little wink after offering a pearl of wisdom that he knew was just beyond your grasp.

Minsky always said he stood on the shoulders of giants. He had little interest in mining the scribblings of defunct economists in an attempt to divine what they really meant. He would probably have little patience with anyone who tries too hard to interpret his own writing. But he did love to be the center of attention, and he was a giant on whose shoulders we can stand.

I thank Seth Ditchik, executive editor at Princeton University Press, for suggesting this project. Eric Tymoigne and some I also thank Esther Minsky, Diana Minsky, and Alan Minsky for their friendship over many years. Most of all, I thank Hyman Minsky for his support and inspiration.

WHY MINSKY MATTERS

Introduction

Stabilityeven of an expansionis destabilizing in that the more adventuresome financing of investment pays off to the leaders and others follow.

Minsky, 1975, p. 125

There is no final solution to the problems of organizing economic life.

Minsky, 1975, p. 168

Why does the work of Hyman P. Minsky matter? Because he saw it (the Global Financial Crisis, or GFC) coming. Indeed, when the crisis first hit, many of those familiar with his work (and even some who knew little about it) proclaimed it a Minsky crisis. That alone should spark interest in his work.

The queen of England famously asked her economic advisors why none of them had seen it coming. Obviously the answer is complex, but it must include reference to the evolution of macroeconomic theory over the postwar periodfrom the Age of Keynes, through the rise of Milton Friedmans monetarism and the return of neoclassical economics in the particularly extreme form developed by Robert Lucas, and finally on to the new monetary consensus adopted by Chairman Bernanke on the precipice of the crisis. The story cannot leave out the parallel developments in finance theorywith its efficient markets hypothesisand the hands-off approach to regulation and supervision of financial institutions.

What passed for macroeconomics on the verge of the global financial collapse had little to do with reality. The world modeled by mainstream economics bore no relation to our economy. It was based on rational expectations in which everyone bets right, at least within a random error, and maximizes anything and everything while living in a world without financial institutions. There are no bubbles, no speculation, no crashes, and no crises in these models. And everyone always pays all debts due on time.

Next page