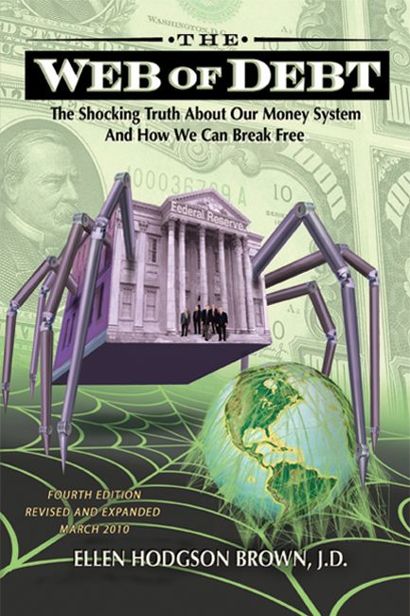

Ellen Hodgson Brown - Web of Debt. The Shocking Truth about our Money System

Here you can read online Ellen Hodgson Brown - Web of Debt. The Shocking Truth about our Money System full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2010, publisher: Third Millenium, genre: Science. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Web of Debt. The Shocking Truth about our Money System

- Author:

- Publisher:Third Millenium

- Genre:

- Year:2010

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Web of Debt. The Shocking Truth about our Money System: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Web of Debt. The Shocking Truth about our Money System" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Ellen Hodgson Brown: author's other books

Who wrote Web of Debt. The Shocking Truth about our Money System? Find out the surname, the name of the author of the book and a list of all author's works by series.

Web of Debt. The Shocking Truth about our Money System — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Web of Debt. The Shocking Truth about our Money System" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

The Shocking Truth About Our Money System and How We Can Break Free

Fourth Edition

Revised and Expanded

ELLEN HODGSON BROWN, J.D.

Third Millennium Press

Baton Rouge, Louisiana

Copyright 2007, 2008, 2010 by Ellen Hodgson Brown

All rights reserved. No part of this book may be reproduced or transmitted in any form or by means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the publisher.

First edition July 2007; Second edition January 2008; Third edition March 2008, updated December 2008; Fourth edition March 2010, updated October 2010.

Cover art by David Dees www.deesillustration.com

Library of Congress Control Number 2008910272 Includes bibliographic references, glossary and index. Subject headings:

Banks and banking United States. Debt United States. Developing countries Economic policy. Federal Reserve banks History. Financial crises United States. Imperialism History 20th century. Greenbacks History. Monetary policy. Money History. United States Economic policy.

Published by Third Millennium Press Baton Rouge, Louisiana www.webofdebt.com 800-891-0390 Printed in USA

ISBN 978-0-9795608-8-0 (print edition)

ISBN 978-0-9833308-1-3 (Kindle)

Section I: THE YELLOW BRICK ROAD:

FROM GOLD TO FEDERAL RESERVE NOTES:

Somebody once said works of art are never finished, just relinquished to the world. This research is a work in progress, begun when I was a law student in the 1970s but was limited to the material available in the library and in journals. With the explosion of information in the Internet Age, the missing pieces have fallen into place; but while I spent nearly six years assembling them before going to press in July 2007, I still found errors, quotes that turned out to be apocryphal, and things needing to be updated. In the time since this book was first published, the banking system has also fractured and the economic scene has changed, prompting a series of revisions.

I have heavily footnoted my sources and quoted extensively, in hopes of aiding the next generation of researchers who might be inspired to carry on the pursuit. Internet cites may change, in which case try googling the title. For additional updates, see www.webofdebt.com/articles.

It has been pointed out to me that some of my sources are controversial, so I will add this disclaimer: in quoting or citing sources, I do not mean to endorse their political positions or views. They are included because they are informative, colorful, or part of a developing historical progression. I do not belong to any political organization and am not funded by any group. My intention has been to build historical sources into a coherent story that is easy to read and engaging.

Ellen Hodgson Brown

Los Angeles, California

February 2010

To my grandmother Ella Mae Hodgson, who died in difficult circumstances during the Great Depression; and to my parents Al and Genny Hodgson,who lived through it.

This book has been heavily shaped by the feedback of many astute friends, who have puzzled over the concepts and helped me to make them easy to understand; and of a number of experts who have helped me to understand them myself. Georgia Wooldridge advised on structural design with an architects eye. Bob Silverstein looked at the material with a sharp agents eye. Gene Harter and Lance Haddix reviewed it from a bankers perspective. My children Jeff and Jamie Brown challenged it as graduate students in economics. Paul Hodgson gave the libertarian perspective. Lawrence Bologna and Don Bruce did detailed editings. Duane Thorin brought a fresh critical approach to the material; and Toni Decker, who purports to know nothing about banking, spotted issues Alan Greenspan might have missed. Important insights were also added by Nancy Batchelder, Eddy Taylor, Richard Miles, Bruce Baumrucker, Paul Hunt, Bob Poteat, Nancy OHara, Tom Nead, David Edgerton and Bonnie Lange. Among the experts, Ed Griffin, Ben Gisin, and Reed Simpson clarified the mysteries of fractional reserve banking; Sergio Lub, Tom Greco, Carol Brouillet and Bernard Lietaer developed community currency concepts; and Stephen Zarlenga, Bill Still and Patrick Carmack illuminated the Greenback solution. Valuable insights for revisions were provided by Alistair McConnachie, Peter Challen, Rodney Shakespeare, Frank Taylor, Glen Martin and Roberta Kelly. Cordell Svengalis and Kim Martin struggled with formatting. Charles Montgomery experimented with graphics, and David Dees captured the theme in a brilliant cover. Cliff Brown made this book possible. Acknowledgment is also due to Michael Hodges and babylontoday.com for their charts, and to all those researchers who uncovered the puzzle pieces assembled here, who are liberally cited and quoted hereafter. Thanks!

by REED SIMPSON, M.Sc., Banker and Developer

I have been a banker for most of my career, and I can report that even most bankers are not aware of what goes on behind closed doors at the top of their field. Bankers tend to their own corner of the banking business, without seeing the big picture or the ramifications of the whole system they are helping to perpetuate. I am more familiar than most with the issues raised in Ellen Browns book Web of Debt , and I still found it to be an eye-opener, a remarkable window into what is really going on.

The process by which money comes into existence is thoroughly misunderstood, and for good reason: it has been the focus of a highly sophisticated and long-term disinformation campaign that permeates academia, media, and publishing. The complexity of the subject has been intentionally exploited to keep its mysteries hidden. Henry Ford said it best: It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.

In banking schools and universities, I was drilled in the technology of money and banking, clearing houses, the Federal Reserve System, money creation through the multiplier effect, and the peculiar role of the commercial banker as the guardian of the public treasure. This idealized vision contrasted sharply with what I saw as I worked in the

U.S. banking sector. Although there are many financially sound banks that follow the highest ethical standards, corruption is also rampant that flies in the face of the stated ethical objectives of the American Bankers Association and the guidelines of the FDIC, the Comptroller of the Currency, and other regulators. This tendency is particularly evident in the large money center banks, in one of which I worked.

In my experience, in fact, the chief source of bank robbery is not masked men looting tellers cash tills but the blatant abuse of the extension of credit by white collar criminals. A common practice is for loan officers to ignore the long-term risk of loans and approve those loan transactions with the highest fees and interest paid immediately income which can be distributed to the principal executives of the bank. Such distribution is buried within the banks owner/manager compensation and is distributed to the principal owners as dividends and stock options. That helps explain why, in my home state of Kansas, a major bank in Topeka was run into bankruptcy after its chairman entered into a development and construction loan involving a mortgaged 5,000 acre residential development tract in the exurbs far outside of Houston, Texas. The development included curbs, gutters, pavement, street lighting, water, sewer, electricity everything but homes and families! If the loan had been metered out in small phases to match market absorption, the chairman of that once-fine institution would not have been able to disburse to himself and his friends the enormous up-front loan fees and interest owing to that specific transaction, or to the many loans he made just like it. During the 1980s, developers from across the country beat a path to sleepy Topeka and other areas sporting similar financial institutions, just to have a chance to dance with these corrupt lenders. The managers and developers got rich, leaving the banks shareholders and the taxpayers to pay the bill.

Font size:

Interval:

Bookmark:

Similar books «Web of Debt. The Shocking Truth about our Money System»

Look at similar books to Web of Debt. The Shocking Truth about our Money System. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Web of Debt. The Shocking Truth about our Money System and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.