Duane Milano - Accounting I Essentials

Here you can read online Duane Milano - Accounting I Essentials full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2012, publisher: INscribe Digital;Research & Education Association, genre: Children. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Accounting I Essentials

- Author:

- Publisher:INscribe Digital;Research & Education Association

- Genre:

- Year:2012

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

Accounting I Essentials: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Accounting I Essentials" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

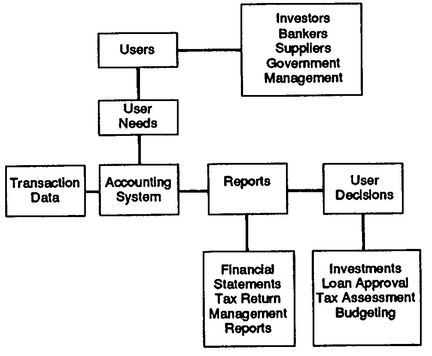

REAs Essentials provide quick and easy access to critical information in a variety of different fields, ranging from the most basic to the most advanced. As its name implies, these concise, comprehensive study guides summarize the essentials of the field covered. Essentials are helpful when preparing for exams, doing homework and will remain a lasting reference source for students, teachers, and professionals. Accounting I includes accounting principles, the accounting cycle, adjusting entries, closing entries, worksheet procedures, accounting for a merchandising operation, internal control and specialized journals, cash, receivables, inventory, property, plants and equipment, and long-term assets.

Duane Milano: author's other books

Who wrote Accounting I Essentials? Find out the surname, the name of the author of the book and a list of all author's works by series.