Michael Lewis - The Big Short: Inside the Doomsday Machine

Here you can read online Michael Lewis - The Big Short: Inside the Doomsday Machine full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2010, publisher: W. W. Norton & Company, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Big Short: Inside the Doomsday Machine

- Author:

- Publisher:W. W. Norton & Company

- Genre:

- Year:2010

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

The Big Short: Inside the Doomsday Machine: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Big Short: Inside the Doomsday Machine" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

The Big Short: Inside the Doomsday Machine — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Big Short: Inside the Doomsday Machine" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

The Big Short

Also by Michael Lewis

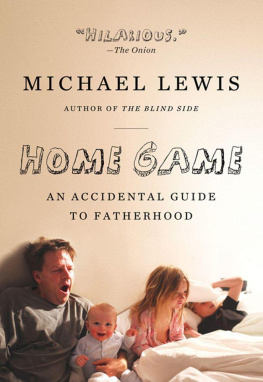

Home Game

Liar's Poker

The Money Culture

Pacific Rift

Losers

The New New Thing

Next

Moneyball

Coach

The Blind Side

EDITED BY MICHAEL LEWIS

Panic

The Big Short

INSIDE THE DOOMSDAY MACHINE

Michael Lewis

W. W. NORTON & COMPANY

NEW YORK LONDON

Copyright (c) 2010 by Michael Lewis

All rights reserved

For information about permission to reproduce selections from this book, write to Permissions, W. W. Norton & Company, Inc., 500 Fifth Avenue, New York, NY 10110

ISBN: 978-0-393-07819-0

W. W. Norton & Company, Inc.

500 Fifth Avenue, New York, N.Y. 10110

www.wwnorton.com

W. W. Norton & Company Ltd.

Castle House, 75/76 Wells Street, London W1T 3QT

For

Michael Kinsley

To whom I still owe an article

The most difficult subjects can be explained to the most slow-witted man if he has not formed any idea of them already; but the simplest thing cannot be made clear to the most intelligent man if he is firmly persuaded that he knows already, without a shadow of doubt, what is laid before him.--Leo Tolstoy, 1897Contents

PROLOGUE

Poltergeist

The willingness of a Wall Street investment bank to pay me hundreds of thousands of dollars to dispense investment advice to grown-ups remains a mystery to me to this day. I was twenty-four years old, with no experience of, or particular interest in, guessing which stocks and bonds would rise and which would fall. Wall Street's essential function was to allocate capital: to decide who should get it and who should not. Believe me when I tell you that I hadn't the first clue. I'd never taken an accounting course, never run a business, never even had savings of my own to manage. I'd stumbled into a job at Salomon Brothers in 1985, and stumbled out, richer, in 1988, and even though I wrote a book about the experience, the whole thing still strikes me as totally preposterous--which is one reason the money was so easy to walk away from. I figured the situation was unsustainable. Sooner rather than later, someone was going to identify me, along with a lot of people more or less like me, as a fraud. Sooner rather than later would come a Great Reckoning, when Wall Street would wake up and hundreds, if not thousands, of young people like me, who had no business making huge bets with other people's money or persuading other people to make those bets, would be expelled from finance.

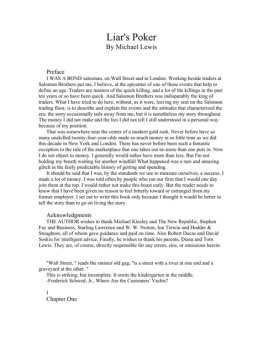

When I sat down to write my account of the experience-- Liar's Poker , it was called--it was in the spirit of a young man who thought he was getting out while the getting was good. I was merely scribbling down a message and stuffing it into a bottle for those who passed through these parts in the far distant future. Unless some insider got all of this down on paper, I figured, no future human would believe that it had happened.

Up to that point, just about everything written about Wall Street had been about the stock market. The stock market had been, from the very beginning, where most of Wall Street lived. My book was mainly about the bond market, because Wall Street was now making even bigger money packaging and selling and shuffling around America's growing debts. This, too, I assumed was unsustainable. I thought that I was writing a period piece about the 1980s in America, when a great nation lost its financial mind. I expected readers of the future would be appalled that, back in 1986, the CEO of Salomon Brothers, John Gutfreund, was paid $3.1 million as he ran the business into the ground. I expected them to gape in wonder at the story of Howie Rubin, the Salomon mortgage bond trader, who had moved to Merrill Lynch and promptly lost $250 million. I expected them to be shocked that, once upon a time on Wall Street, the CEOs had only the vaguest idea of the complicated risks their bond traders were running.

And that's pretty much how I imagined it; what I never imagined is that the future reader might look back on any of this, or on my own peculiar experience, and say, "How quaint." How innocent. Not for a moment did I suspect that the financial 1980s would last for two full decades longer, or that the difference in degree between Wall Street and ordinary economic life would swell to a difference in kind. That a single bond trader might be paid $47 million a year and feel cheated. That the mortgage bond market invented on the Salomon Brothers trading floor, which seemed like such a good idea at the time, would lead to the most purely financial economic disaster in history. That exactly twenty years after Howie Rubin became a scandalous household name for losing $250 million, another mortgage bond trader named Howie, inside Morgan Stanley, would lose $9 billion on a single mortgage trade, and remain essentially unknown, without anyone beyond a small circle inside Morgan Stanley ever hearing about what he'd done, or why.

When I sat down to write my first book, I had no great agenda, apart from telling what I took to be a remarkable tale. If you'd gotten a few drinks in me and then asked what effect the book would have on the world, I might have said something like, "I hope that college students trying to decide what to do with their lives might read it and decide that it's silly to phony it up, and abandon their passions or even their faint interests, to become financiers." I hoped that some bright kid at Ohio State University who really wanted to be an oceanographer would read my book, spurn the offer from Goldman Sachs, and set out to sea.

Somehow that message was mainly lost. Six months after Liar's Poker was published, I was knee-deep in letters from students at Ohio State University who wanted to know if I had any other secrets to share about Wall Street. They'd read my book as a how-to manual.

In the two decades after I left, I waited for the end of Wall Street as I had known it. The outrageous bonuses, the endless parade of rogue traders, the scandal that sank Drexel Burnham, the scandal that destroyed John Gutfreund and finished off Salomon Brothers, the crisis following the collapse of my old boss John Meriwether's Long-Term Capital Management, the Internet bubble: Over and over again, the financial system was, in some narrow way, discredited. Yet the big Wall Street banks at the center of it just kept on growing, along with the sums of money that they doled out to twenty-six-year-olds to perform tasks of no obvious social utility. The rebellion by American youth against the money culture never happened. Why bother to overturn your parents' world when you can buy it and sell off the pieces?

At some point, I gave up waiting. There was no scandal or reversal, I assumed, sufficiently great to sink the system.

Then came Meredith Whitney, with news. Whitney was an obscure analyst of financial firms for an obscure financial firm, Oppenheimer and Co., who, on October 31, 2007, ceased to be obscure. On that day she predicted that Citigroup had so mismanaged its affairs that it would need to slash its dividend or go bust. It's never entirely clear on any given day what causes what inside the stock market, but it was pretty clear that, on October 31, Meredith Whitney caused the market in financial stocks to crash. By the end of the trading day, a woman whom basically no one had ever heard of, and who could have been dismissed as a nobody, had shaved 8 percent off the shares of Citigroup and $390 billion off the value of the U.S. stock market. Four days later, Citigroup CEO Chuck Prince resigned. Two weeks later, Citigroup slashed its dividend.

From that moment, Meredith Whitney became E. F. Hutton: When she spoke, people listened. Her message was clear: If you want to know what these Wall Street firms are really worth, take a cold, hard look at these crappy assets they're holding with borrowed money, and imagine what they'd fetch in a fire sale. The vast assemblages of highly paid people inside them were worth, in her view, nothing. All through 2008, she followed the bankers' and brokers' claims that they had put their problems behind them with this write-down or that capital raise with her own claim: You're wrong. You're still not facing up to how badly you have mismanaged your business. You're still not acknowledging billions of dollars in losses on subprime mortgage bonds. The value of your securities is as illusory as the value of your people. Rivals accused Whitney of being overrated; bloggers accused her of being lucky. What she was, mainly, was right. But it's true that she was, in part, guessing. There was no way she could have known what was going to happen to these Wall Street firms, or even the extent of their losses in the subprime mortgage market. The CEOs themselves didn't know. "Either that or they are all liars," she said, "but I assume they really just don't know."

Next pageFont size:

Interval:

Bookmark:

Similar books «The Big Short: Inside the Doomsday Machine»

Look at similar books to The Big Short: Inside the Doomsday Machine. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Big Short: Inside the Doomsday Machine and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.