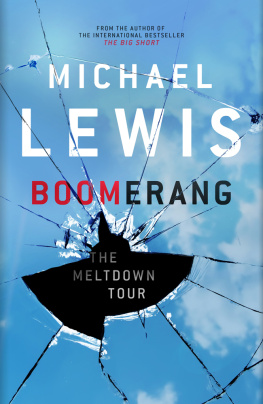

ALSO BY MICHAEL LEWIS

The Big Short

Home Game

Liars Poker

The Money Culture

Pacific Rift

Losers

The New New Thing

Next

Moneyball

Coach

The Blind Side

EDITED BY MICHAEL LEWIS

Panic

Michael Lewis

Travels in the New Third World

W. W. Norton & Company

New York London

To Doug Stumpf, gifted editor and gentle soul, without whom it never would have occurred to me to tour the ruins

CONTENTS

I

II

III

IV

V

PREFACE

THE BIGGEST SHORT

T his book began accidentally, while I was at work on another book, about Wall Street and the 2008 U.S. financial disaster. Id become interested in a tiny handful of investors who had made their fortunes from the collapse of the subprime mortgage market. Back in 2004, the biggest Wall Street investment banks had created the instrument of their own destruction, the credit default swap on the subprime mortgage bond. The credit default swap enabled investors to bet against the price of any given bondto short it. It was an insurance policy, but with a twist: the buyer didnt need to own the insured asset. No insurance company can legally sell you fire protection on another persons house, but the financial markets can and will sell you default insurance on another persons investments. Hundreds of investors had dabbled in the credit default swap marketa lot of people had thought, at least in passing, that the debt-fueled U.S. housing boom was unsustainablebut only fifteen or so had gone all in, and placed enormous bets that vast tracts of American finance would go up in flames. Most of these people ran hedge funds in London or New York; most, usually, avoided journalists. But on this topic, at this moment, they were surprisingly open. All had experienced the strange and isolating sensation of being the sane man in an insane world and, when they talked about their experience, sounded as a person might if he had sat alone and in silence in a small boat and watched the Titanic steam into the iceberg.

A few of these people were temperamentally ill-suited to solitude and silence. Among this subset was the manager of a hedge fund called Hayman Capital, in Dallas, Texas. His name was Kyle Bass. Bass was a native Texan in his late thirties who had spent the first years of his career, seven of them at Bear Stearns, selling bonds for Wall Street firms. In late 2006 hed taken half of the $10 million he had saved from his Wall Street career, raised another $500 million from other people, created his hedge fund, and made a massive wager against the subprime mortgage bond market. Then hed flown to New York to warn his old friends that they were on the wrong side of a lot of stupid bets. The traders at Bear Stearns had no interest in what he had to say. You worry about your risk management. Ill worry about ours, one of them had told him. By the end of 2008, when I went to Dallas to see Bass, the subprime mortgage bond market had collapsed, taking Bear Stearns with it. He was now rich and even, in investment circles, a little famous. But his mind had moved on from the subprime mortgage bond debacle: having taken his profits, he had a new all-consuming interest, governments. The United States government was just then busy taking on to its own books the subprime loans made by Bear Stearns and other Wall Street banks. The Federal Reserve would wind up absorbing the risk, in one form or another, associated with nearly $2 trillion in dodgy securities. Its actions were of a piece with those of other governments in the rich, developed world: the bad loans made by highly paid financiers working in the private sector were being eaten by national treasuries and central banks everywhere.

In Kyle Basss opinion, the financial crisis wasnt over. It was simply being smothered by the full faith and credit of rich Western governments. I spent a day listening to him and his colleagues discuss, almost giddily, where this might lead. They were no longer talking about the collapse of a few bonds. They were talking about the collapse of entire countries.

And they had a shiny new investment thesis. It ran, roughly, as follows. From 2002 there had been something like a false boom in much of the rich, developed world. What appeared to be economic growth was activity fueled by people borrowing money they probably couldnt afford to repay: by their rough count, worldwide debts, public and private, had more than doubled since 2002, from $84 trillion to $195 trillion. Weve never had this kind of accumulation of debt in world history, said Bass. Critically, the big banks that had extended much of this credit were no longer treated as private enterprises but as extensions of their local governments, sure to be bailed out in a crisis. The public debt of rich countries already stood at what appeared to be dangerously high levels and, in response to the crisis, was rapidly growing. But the public debt of these countries was no longer the official public debt. As a practical matter it included the debts inside each countrys banking system, which, in another crisis, would be transferred to the government. The first thing we tried to figure out, said Bass, was how big these banking systems were, especially in relation to government revenues. We took about four months to gather the data. No one had it.

The numbers added up to astonishing totals: Ireland, for instance, with its large and growing annual deficits, had amassed debts of more than twenty-five times its annual tax revenues. Spain and France had accumulated debts of more than ten times their annual revenues. Historically, such levels of government indebtedness had led to government default. Heres the only way I think things can work out for these countries, Bass said. If they start running real budget surpluses. Yeah, and that will happen right after monkeys fly out of your ass.

Still, he wondered if perhaps he was missing something. I went looking for someone, anyone, who knew something about the history of sovereign defaults, he said. He found the leading expert on the subject, a professor at Harvard named Kenneth Rogoff, who, as it happened, was preparing a book on the history of national financial collapse, This Time Is Different: Eight Centuries of Financial Folly , with fellow scholar Carmen Reinhart. We walked Rogoff through the numbers, said Bass, and he just looked at them, then sat back in his chair, and said, I can hardly believe it is this bad. And I said, Wait a minute. Youre the worlds foremost expert on sovereign balance sheets. You are the go-to guy for sovereign trouble. You taught at Princeton with Ben Bernanke. You introduced Larry Summers to his second wife. If you dont know this, who does? I thought, Holy shit, who is paying attention?

Thus his new investment thesis: the subprime mortgage crisis was more symptom than cause. The deeper social and economic problems that gave rise to it remained. The moment that investors woke up to this reality, they would cease to think of big Western governments as essentially risk-free and demand higher rates of interest to lend to them. When the interest rates on their borrowing rose, these governments would plunge further into debt, leading to further rises in the interest rates they were charged to borrow. In a few especially alarming casesGreece, Ireland, Japanit wouldnt take much of a rise in interest rates for budgets to be consumed entirely by interest payments on debt. For example, said Bass, if Japan had to borrow at Frances rates, the interest burden alone would bankrupt the government. The moment the financial markets realized this, investor sentiment would shift. The moment investor sentiment shifted, these governments would default. (Once you lose confidence, you dont get it back. You just dont.) And then what? The financial crisis of 2008 was suspended only because investors believed that governments could borrow whatever they needed to rescue their banks. What happened when the governments themselves ceased to be credible?

Next page