Contents

Guide

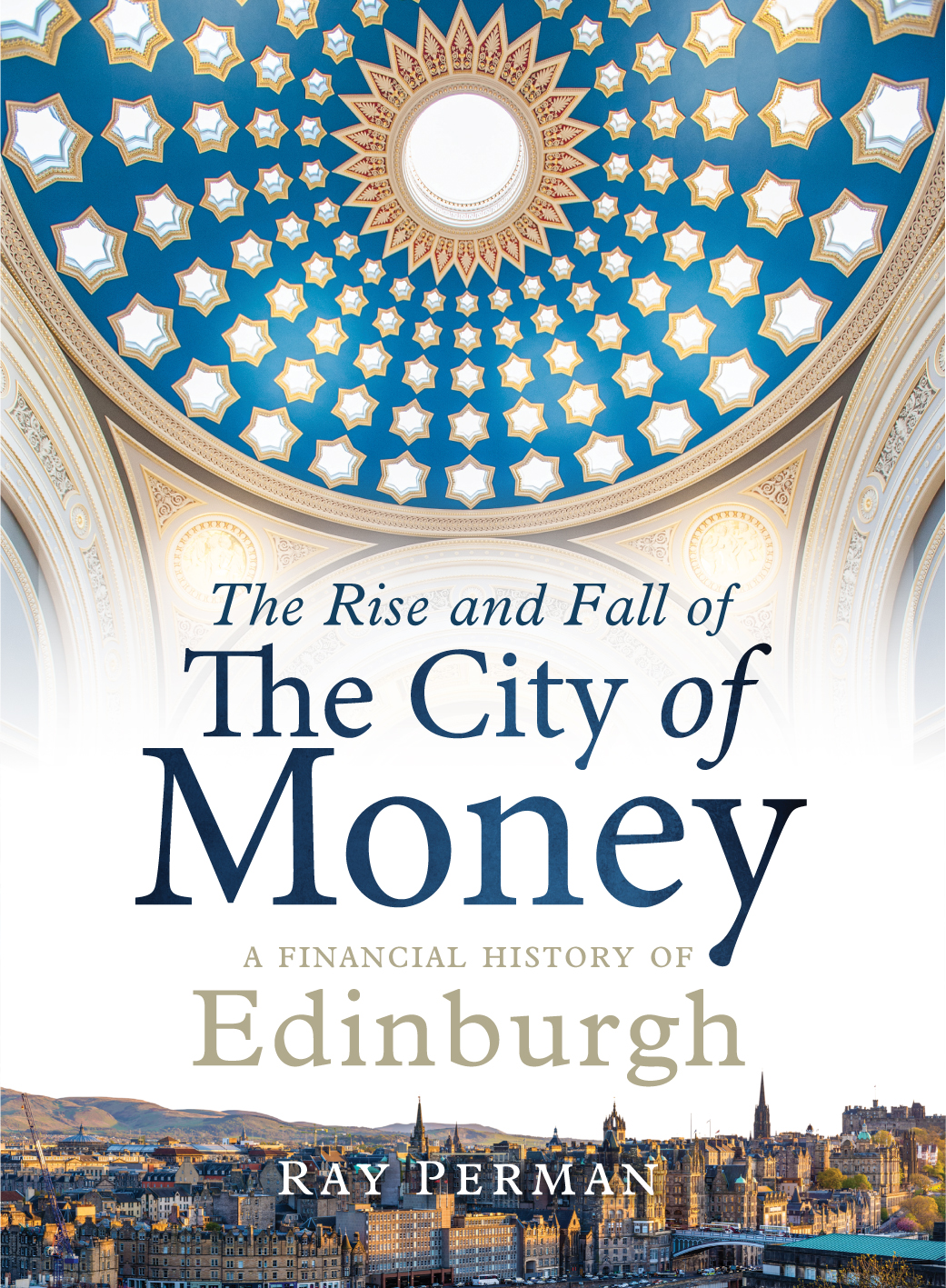

THE RISE

AND FALL OF

THE CITY OF

MONEY

For the Library of Mistakes and Russell Napier, its founder

First published in 2019 by

Birlinn Limited

West Newington House

10 Newington Road

Edinburgh

EH9 1QS

www.birlinn.co.uk

Copyright Ray Perman 2019

ISBN 978 1 78885 229 6

The right of Ray Perman to be identified as Author of this work has been asserted by him in accordance with the Copyright, Designs and Patents Act 1988.

All rights reserved. No part of this publication may be reproduced in any form or by any means without permission from the publisher.

British Library Cataloguing in Publication Data

A catalogue record for this book is available from the British Library.

Typeset by Hewer Text UK Ltd, Edinburgh

Printed and bound by Gutenberg Press, Malta

Progress is cumulative in science and engineering, but cyclical in finance.

James Grant in Money of the Mind, 1994

Contents

List of Plates

Edinburgh in 1647

Journal of the Company of Scotland, which planned the ill-fated Darien colony

The earliest surviving Scottish banknote

The Darien Kist

An early Royal Bank of Scotland note

Alexander Webster, co-author of the worlds first pension scheme based on actuarial principles

John Campbell, chief cashier of Royal Bank when Bonnie Prince Charlie entered Edinburgh

George Drummond, lord provost of Edinburgh

How an English lampoonist saw the credit crisis of 1772 and the collapse of the Ayr bank

The Mound in 1809

Henry Dundas

A bond for Gregor MacGregors fictional state of Poyais

Sir Walter Scott

An accommodation bill from Archibald Constable to Sir Walter Scott

How a cartoonist saw the English and Scottish money markets during the crisis of 1825

Crest for Caledonian Insurance, designed by Henry Raeburn

The telling room added to the Royal Bank head office in 1856

Trial of the directors of the failed City of Glasgow Bank in 1879

Calendar for the Scottish Union & National Insurance Company for 1899

Poster for Scottish Widows from 1890

Leonard Dickson, chief executive of Standard Life Assurance

National Bank of Scotlands head office in St Andrew Square

Note issued by the Union Bank of Scotland, which merged with Bank of Scotland in 1955

An advertisement showing the head office of the Commercial Bank of Scotland, in George Street, Edinburgh

Banknote issued by the National Commercial Bank

Carlyle Gifford

Bruce Pattullo

Tom Risk

George Mathewson

George Younger

Charles Winter

Peter Burt

James Crosby

Lord Stevenson

Fred Goodwin

Lord Stevenson, Andy Hornby, Fred Goodwin and Sir Tom McKillop face the House of Commons Treasury Committee, 2009

Preface

THIS STORY IS bookended by two financial catastrophes the Darien disaster at the beginning of the eighteenth century and the credit crunch in the twenty-first. There were numerous financial crashes in between, but none had the potential to bankrupt the nation as those two did. Can we learn anything from them? Why study the history of finance when the financial regulator tells us that the past is not necessarily a guide to the future? What similarities could there be between William Patersons unsuccessful attempt to drive Bank of Scotland out of business and the failure of Royal Bank of Scotland more than three centuries later? Banking was so much simpler in 1695 than it was in 2008 that the two events cannot be compared.

And yet, the economic cycle of boom and bust has been repeated many times (and could not be abolished by political will, no matter how sophisticated the economic policy). Long periods of easily available cheap money followed by a sudden tightening of credit has been the background to several catastrophic events: the collapse of the Bank of Ayr in 1772, the financial ruin of Sir Walter Scott in 1825, the failure of the City of Glasgow Bank in 1878, the downfall of Bank of Scotland and Royal Bank of Scotland in 2008. And, although history never repeats itself exactly, there are some things that do not change.

In this book I have tried to tell the story of Scottish finance and particularly how Edinburgh came to be the only city in the UK to have resisted the pull of London and maintained an independent financial sector up until the twenty-first century. Partly that is an accident of history the founding of Bank of Scotland before 1707 gave it rights and privileges independent of the Bank of England. These were not removed by the Act of Union, and Scotland retained sufficient autonomy and political strength to be able to keep its banks free of the restrictions which stunted the growth of rivals to the Old Lady of Threadneedle Street south of the border. The settlement also left Scotland with distinctive civic institutions, particularly a separate legal system, but also the Church, schools and universities. Lawyers played a big part in the development of finance in Scotland, but so did kirk ministers and professors of mathematics. They were joined in time by a set of independent professional institutes banking, law, accountancy and actuarial mathematics.

This is not just a story of institutions, but also of people. Some were visionary, some energetic; some were incompetent and some comic. I have tried to sketch some of their biographies and to give links in the bibliography to where to find fuller pictures. Overwhelmingly they were men. Very few women were allowed to play full parts in this story, even though their money and their willingness to take risks were important from the very beginning.

* * *

The inspiration for this book came from Russell Napier, a finance professional with a passionate interest in economic history and a belief that there is much modern practitioners can gain from the lessons of the past. He has given that idea tangible form in two ways: the Practical History of Financial Markets is a short course for finance professionals, which is taught in Edinburgh, London and abroad; The library is open to anyone, is free to join, and organises regular talks and a book club. Some years ago Russell invited me to help him lead an annual financial walking tour of Edinburgh for students at the University of Edinburgh Business School. The compact historic city centre is a case study in the way that economic and financial events help shape the environment in which we live and, although fire and redevelopment have removed some of the buildings and sites which were the setting for episodes described here, enough survive to help bring the history to life. I hope this book will complement the tour and enable readers to plot their own journeys around the city.

Others have also helped me with this book and deserve my thanks. Dr Charles Munn is not only a distinguished author and financial historian, but also a former chief executive of the Chartered Institute of Bankers in Scotland, the worlds oldest banking institute. His suggestions and ideas have been invaluable. I am grateful too to Dr Douglas Watt, Dr Claire Anderson and Trevor Davies for reading and commenting on parts of the manuscript. Professor Fran Wasoff helped me organise my research. Dr Paul Kosmetatos guided me to valuable sources of information. My wife, Fay Young, is an author and editor in her own right, and Im grateful for her patience, perceptiveness and encouragement.