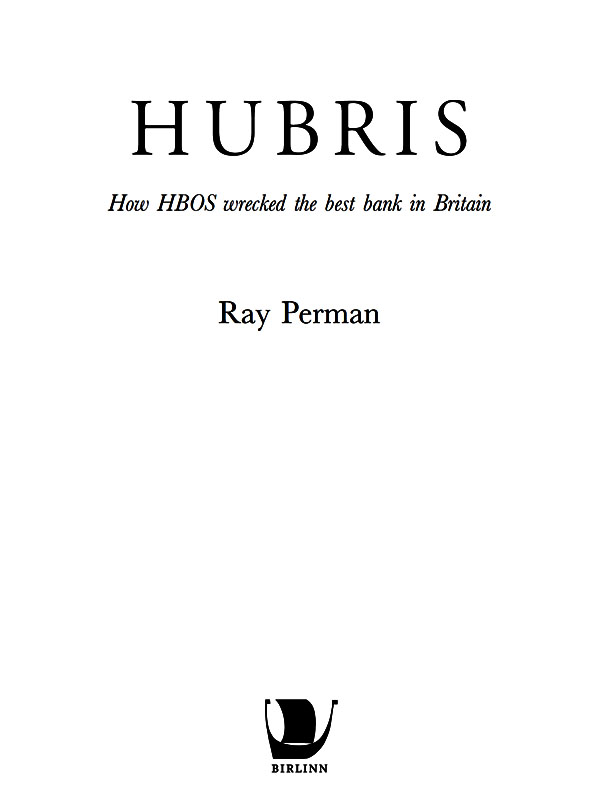

HUBRIS

Ray Perman was a journalist in London and Edinburgh for thirty years. He was a co-founder of the business magazine Insider Publications and was Chief Executive of Scottish Financial Enterprise from 1999 to 2003. In 2011 he was appointed Chairman of the James Hutton Institute, the first institute of its type in Europe dedicated to making new contributions to the understanding of key global issues such as food, energy and environmental security.

This eBook edition published in 2013 by

Birlinn Limited

West Newington House

Newington Road

Edinburgh

EH9 1QS

www.birlinn.co.uk

First published in 2012 by Birlinn Limited

Copyright Ray Perman, 2012, 2013

Foreword copyright Alistair Darling, 2012

The moral right of Ray Perman to be identified as the author of this work has been asserted by him in accordance with the Copyright, Designs and Patents Act 1988

All rights reserved. No part of this publication may be reproduced, stored or transmitted in any form without the express written permission of the publisher.

Print ISBN: 978-1-78027-132-3

eBook ISBN: 978-0-85790-229-0

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library

Version 2.0

In the eye of the storm, Nemesis followed Hubris

Lord Stevenson of Coddingham,

chairman, HBOS, annual report 2007

List of Illustrations

Foreword

My years in the Treasury during the financial collapse of 20078 gave me more hands-on practice dealing with banks than any Chancellor of the Exchequer in living memory. During frequent increasingly tense meetings I also came face to face with the men running those institutions. It is not an experience I would recommend. Northern Rock was the first British casualty of a storm which was to engulf dozens of banks in the US and Europe, but in August 2007, when I asked for a list from my officials of other banks that might be exposed to the US market, HBOS was there.

This is a story about the downfall of one bank, but it is more than that. The consequences of the 2008 banking collapse in Scotland, the UK and in Europe have proved catastrophic. The economic crisis that resulted threatens years of stagnation, with little growth, high unemployment and lost opportunities. How could it happen? We need to understand that to know what lessons to draw from it.

The headquarters of the Bank of Scotland on the Mound dominated the Edinburgh skyline for centuries. It was a symbol of strength. The Bank of Scotland, founded in 1695, had come to represent all that was best in Scottish financial acumen. It began lending money to the Scottish nobility with loans secured on good quality land. It understood the risks it undertook and it prospered. By the late 20th century it was seen as a solidly sound if unexciting bank. Then, in the late 1990s, the bank made the decision to merge with the Halifax Building Society to form HBOS. The Halifax was Britains biggest building society. It too had prospered. But this was a marriage made on the rebound.

The Bank of Scotland had decided to pursue the takeover of the National Westminster Bank, one of the UKs biggest banks which was viewed as under-performing No sooner had it done so than its old rival, the Royal Bank of Scotland, entered the fray. The Royal Bank pursued an aggressive campaign to win Nat West, judging that whichever bank seized the prize would establish itself as a dominant UK presence. The Royal Bank won. Shortly afterwards, the Bank of Scotland felt exposed. Having lost the bid it could not afford to stand still hence the merger with the Halifax.

The new bank was now under a different management style. It began to pursue an aggressive lending policy to personal and business customers. In particular it pursued a policy of expanding its market share in the domestic mortgage market and also started lending billions of pounds for commercial property. It was taking on risks that it did not understand. By 2008, as the global banking crisis took hold, HBOS found itself hopelessly over-exposed and facing collapse. It had no option but to agree to a takeover by Lloyds Bank in September of that year.

HBOS was not alone in lending billions of pounds on the back of rapidly rising house prices and a property market which seemed to promise limitless returns. In Ireland, the banks were similarly exposed. So too was HBOS and RBS, through its subsidiary Ulster Bank. The sheer scale of the losses incurred by the Irish banks were to bring down the Irish government which was forced to go to the International Monetary Fund and to fellow eurozone members for a bail out. A similar property bubble left many Spanish banks in a similar state, forcing the Spanish government to seek almost 100 billion euros from eurozone members in the summer of 2012. Other banks too, particularly in continental Europe, remained fearful that the continuing economic downturn would result in many of their loans turning bad, leaving them with losses.

Although it is easy now to identify what went wrong, no regulator anywhere in the world picked up on the growing risks the banking system faced in the mid part of the last decade. But the warning signs were there. Indeed many of the symptoms were spotted, but nowhere did anyone bring together all the warning signs before disaster struck. In particular, the trade in sophisticated financial products which brought down many US banks and RBS here in the UK were not fully understood by the banks themselves. There seemed to be an assumption that if everyone was making money from these trades that they must be all right. Very few were prepared to ask themselves what exactly these products were worth. The answer was very little.

Primary responsibility must rest with the boards of these banks. The board of a company has a legal responsibility to its shareholders. Board members should have asked themselves whether they understood the risks to which the bank had become exposed. In lending such huge sums they should have asked themselves what would happen if the borrowers got into trouble and could not repay the debt. This is not rocket science, it is basic banking and as this book shows, it used to be second nature to bankers and to bank boards.

The regulators for their part failed to understand just how exposed some of these banks had become. Worse, they did not appreciate how interconnected the worlds banking system had become. They looked at each bank on its own. They did not ask what would happen if a bank got into trouble, perhaps on the other side of the world and how its problems would spread rapidly through the global banking system. Northern Rock was a well-established provincial building society with deep roots in the north east of England. It had, along with a number of other building societies, demutualised in the 1980s to become banks. During the course of the crisis every single building society that demutualised either failed or had to be taken over. It is instructive to see what happened in the case of Northern Rock.

When building societies were first set up they had a simple model. They took in money from hard-working artisans who in turn borrowed money when they wanted to buy a house. But in the 1990s and in the decade that followed a new model emerged. Banks discovered they could borrow money from other financial institutions across the globe and in particular in the US. The money there was to a large extent generated by the trade of sophisticated financial products, many based on what is now known as the sub-prime mortgage market, involving home loans to people on low incomes, secured on property of little or no value. It was inevitable borrowers would eventually default, and so they did, on an industrial scale. When the crash happened, the money that Northern Rock relied on from this wholesale market dried up and the bank rapidly became insolvent.