Jean Kittson - We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents

Here you can read online Jean Kittson - We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, genre: Home and family. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents

- Author:

- Genre:

- Year:2020

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Jean Kittson: author's other books

Who wrote We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents? Find out the surname, the name of the author of the book and a list of all author's works by series.

We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

About We Need to Talk About Mum & Dad

Everything you need to know about supporting ageing parents, from author and comedian Jean Kittson.

This warm and witty practical guide is a one-stop shop for information on how to support your ageing loved ones: how to protect their health and wellbeing, keep them safe and secure, and enable them to be self-determining and independent for as long as possible.

Full of expert advice and first-hand experience, this is your go-to resource to help you:

- Navigate the bureaucratic maze while remaining sane

- Understand what is needed for your elders health and wellbeing and how to get it, especially in a medical emergency

- Survive the avalanche of legal papers and official forms

- Choose the best place for them to live home, retirement village, residential aged care, or granny and grandpa flat and help your elders relocate with love and respect.

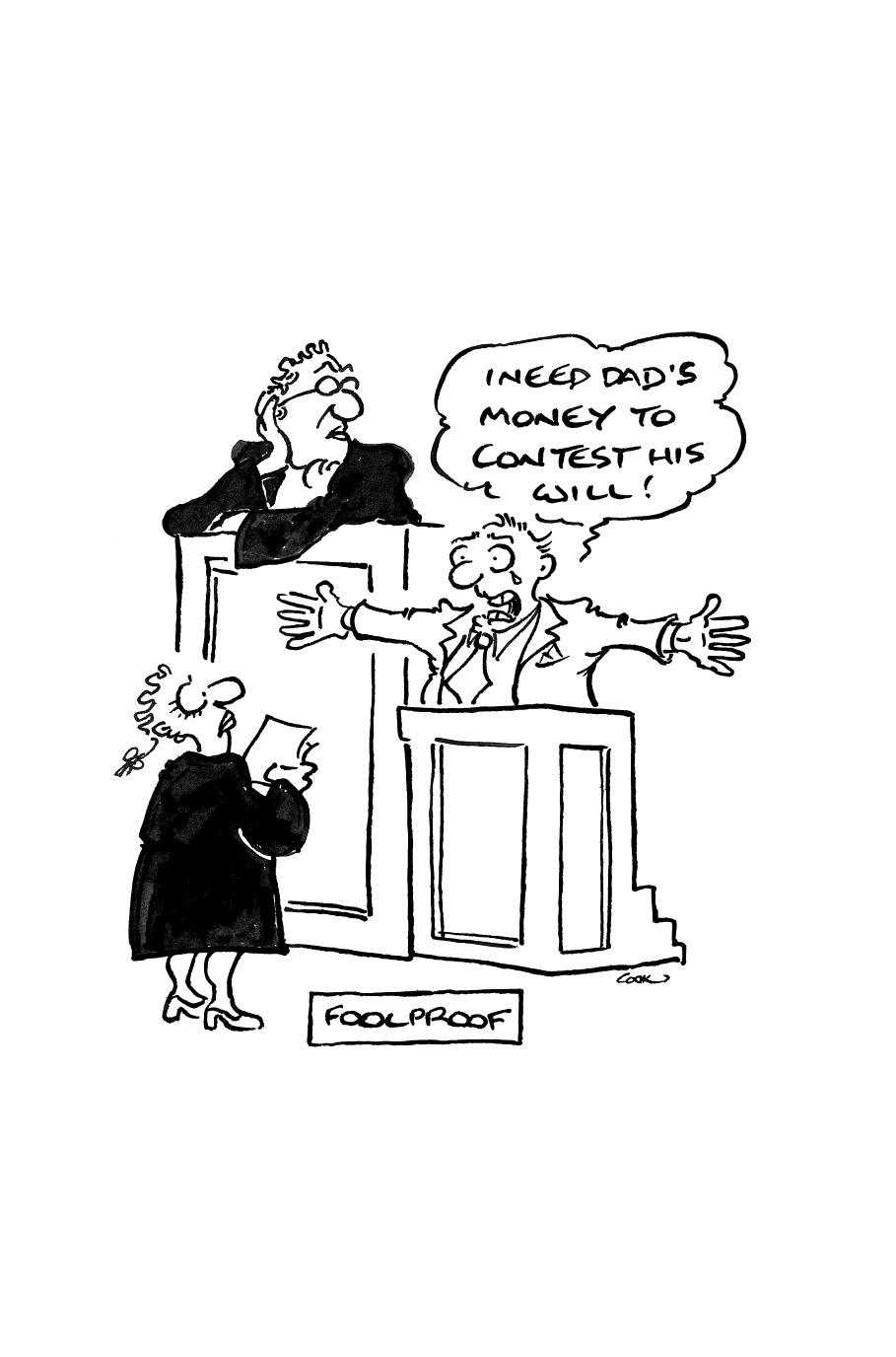

Compelled to discuss some of lifes most confronting questions, Jean shares heartfelt stories and clear facts alongside wonderful cartoons from much-loved Australian cartoonist, Patrick Cook.

Following on from her 2014 bestseller, Youre Still Hot to Me , a treatise on menopause, We Need to Talk About Mum and Dad is a guide to what happens when we become parents of our parents.

Chapter 5

Protecting the family jewels

There are one or two (hah!) things you need to think about to help manage your parents financial health. What are their income and assets now? How can you make an informed guestimate about their future costs and cash flow? Are their banks and insurers and providers treating them well? Are they entitled to any government assistance? Are they getting it?

And, setting aside the implications, you will also need to think about wills. Families can fall apart over a couple of thousand dollars. Financial planners with older clients say that sorting out the financial situation of a partner left behind, or for the family, is the most emotionally distressing and challenging part of their jobs.

How to avoid a financial nightmare

When we parent our children, we teach them how to handle their own money, their super, their tax returns, their bills, their insurance, their credit cards, their investments (when their salaries exceed their phone bills), and all the bookkeeping that comes with growing up.

When it comes to your parents, your goal is to make sure your parents have control and understanding of what happens when things change; when the print on their bank statements becomes smaller, or they outlive their accountant and their lawyer.

You may think this sounds COMPLICATED. This isnt even MY money. I shouldnt have to worry about this for DECADES. But if your parents are elderly, they likely will need your pert young mind to help them find their way through the financial jungle/minefield/maze/cryptic crossword/bureaucratic labyrinth. It will also be valuable match practice for you when you confront this on your own behalf, DECADES later. (Although all the rules and regulations will have changed by then, and will possibly be encrypted, for your personal inconvenience.)

Dont panic. And dont think I am going to tell you how to manage anything. Ha-ha-ha. My arrangements are all managed by highly skilled others. All I do is sign papers every now and then and often I muck that up. Oh, you wanted me to sign them AND return them? Oh, I see, sorry. I thought I just signed them and left them on the floor of my office on top of all the other things I have signed over the years, then made attractive origami swans out of them.

Pay a professional financial advisor/accountant

This is my Top Tip of All Time to help your parents.

There are people who devote their professional lives to monitoring the brain-surges of politicians, and keeping up with changes in fees, entitlements and choices in the aged care sector. (Watch the pollies mouths. When they say ageing population, their lips purse as if they are personally insulted by other peoples birthdays. As if it were their own money.)

A good financial planner will:

- Keep your elders assets safe and accessible.

- Ensure their assets are used to benefit their ongoing care and comfort.

- Ensure government assistance is maximised.

- Keep your parents at the centre of the discussion if they are still able and willing to make decisions.

A good financial planner can either give general or personal advice only, or give personal advice in writing and implement and monitor it on an ongoing basis. Your choice and yes, implementing costs more. Totally worth it.

If you feel you can DIY, most local legal aid and local councils often run free information courses to assist. There is also a free financial information service (FIS) offered by the DHS located at humanservices.gov.au/fis or 132 300. It can help you help your elders make informed financial decisions. FIS officers are not financial planners or counsellors. They dont prepare financial plans or tax returns or tell your parents how to invest, where to buy investment products, or make decisions about their pension. They are Switzerland.

I have a friend, Brendan, who is a financial planner, specialising in aged care:

An important part of planning is integrating aged care costs and making sure that the investments are appropriate for the stage of life people are at.

A colleague of mine asked me to look at his fathers situation. His father is in his nineties and in a retirement village. The father has $900k in his portfolio. The question for his father is, does he need all these risky shares? Because if he needs to go to an aged care facility he will have to come up with cash for the accommodation deposit [see chapter 12]. Having the cash ready to go would be a good start.

Interestingly, people in the financial industry game dont necessarily think like that. Financial advisors make money by supervising your assets, so if you want to convert, say, $600k in managed funds to cash, there may be less money in that for them, so there is going to be a bit of a conflict of interest. And if you are an older client, it is easy for them: they dont have to do any work, they just keep banking the cheques.

There needs to be a whole shift in how you think about your financial planning. People are so used to holding onto assets and living off income from those assets, but, especially getting towards eighty, you should start simplifying your assets significantly, so they are liquid and low risk. (Unless you specifically want to leave these assets to the children.) Remember, governments do not want you to die holding money. They want you to spend it on aged care.

There is a proposition that you have the accumulation phase of your life, like the accumulation phase of your super fund, and then you have the opposite which is a decumulation phase. Once this was a word that no-one thought about because finance was all about building assets and all the financial advice was about building assets. But now there is more talk about the orderly drawdown of assets. You have retired, this is what you saved for and over time your assets are going to get lower.

I just want to add be careful of the drawdown. One financial planner told me, You want your last cheque to bounce. HUH!? Do not take this literally. Who writes a final cheque that bounces? Even if they plan to skip town in the most extreme way, by dying, how do they know it is the final cheque? You could have another ten or twenty years to live, and an angry creditor, possibly the large bloke from the panel beaters.

Font size:

Interval:

Bookmark:

Similar books «We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents»

Look at similar books to We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book We Need to Talk About Mum & Dad: A Practical Guide to Parenting Our Ageing Parents and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.