2012 by Tim Clinton

Published by Baker Books

a division of Baker Publishing Group

P.O. Box 6287, Grand Rapids, MI 49516-6287

www.bakerbooks.com

Ebook edition created 2012

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any meansfor example, electronic, photocopy, recordingwithout the prior written permission of the publisher. The only exception is brief quotations in printed reviews.

ISBN: 978-1-4412-3980-8

Library of Congress Cataloging-in-Publication Data is on file at the Library of Congress, Washington, DC.

Scripture quotations are from the Holy Bible , New International Version . NIV . Copyright 1973 , 1978 , 1984 , 2011 by Biblica , Inc . Used by permission of Zondervan . All rights reserved worldwide. www.zondervan.com

To protect the privacy of those who have shared their stories with the authors , details and names have been changed .

The internet addresses , email addresses , and phone numbers in this book are accurate at the time of publication . They are provided as a resource . Baker Publishing Group does not endorse them or vouch for their content or permanence .

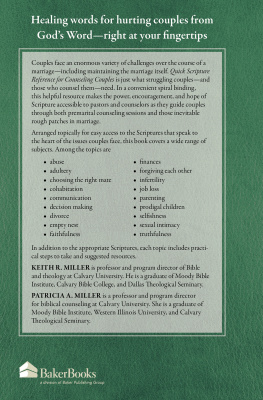

Practical and easy to use. Youll come back to this resource over and over again in your work with couples and families.

Gary Chapman, Marriage & Family Life Consultants, Inc. and author of The 5 Love Languages

If you work with couples or families, this book is an indispensable resource! The authors address real issues and give practical steps to financial and relational health.

Les Parrott, author of Youre Stronger Than You Think

Tim Clinton and Scott and Bethany Palmer have tackled a critical topic with The Quick-Reference Guide to Counseling on Money, Finances & Relationships . In a day when so many marriages are negatively impacted by financial conflicts, this book will be an invaluable resource to Christian therapists seeking to help couples resolve their money issues.

Bill Maier, clinical psychologist and radio host

Ive had the privilege, over almost 40 years, of answering thousands of financial questions and have come to the firm conclusion that almost every financial problem is symptomatic of a spiritual or emotional issue. In many cases the real need is not a financial counselor , but a professional counselor. I am delighted to see this book as a tool for the counseling world.

Ron Blue, president, Kingdom Advisors

Contents

Introduction

Because money is both a universal blessing and concern , The Quick - Reference Guide to Counseling on Money , Finances & Relationships is designed to equip professional counselors , pastors , and lay counselors to help those who are struggling with many and varied financial issues in relationships . Many ( if not most ) people who come for help with relational and emotional problems struggle also with their finances . Money may not be the main reason they came for help , but it s a significant contributing factor due to the fact that money affects just about every aspect of life . If we scratch below the surface , we may realize many of their personal stresses relate to money , and many of the relational difficulties they face are directly related to conflict over money . Studies show that disagreements about money were a major contributing factor in percent of divorces ( First Comes Love , Then Comes Money ). Often financial struggles complicate the emotional and relational difficulties in the lives of those who come for counseling , but relatively few counselors address this important topic .

In this guide we focus on three important areas:

- Defining a financial relationship

- The five Money Personalities

- Forty financial relationship topics

The purpose of this guide is to address the needs of people under emotional and relational strain because of financial problems, no matter how these problems have occurredthrough debt or any other factor. People whose financial struggles have produced anxiety, depression, and family conflict need understanding, support, and direction.

Each of the forty topics includes insights about how to approach clients across the financial spectrum. The issue isnt how much money an individual or a couple has, but how they are handling stress and communication related to their finances.

If you are a professional counselor , this guide can help you:

- accurately determine a clients problems by using the assessments in each section

- see a clients problem and solutions from a biblical perspective

- give clear guidance to your clients so they can take steps forward to resolve pressing financial-communication problems

- create a network of financial professionals and other resources for your clients

If you are a pastor or lay counselor , we recommend that you take time to read through the entire book, marking key points in each section that stand out to you. As you become familiar with the topics, problems, approaches, and resources, you can make a list of referral resources in your community. The guide will help you:

- gain information about the nature of money challenges

- assist you in compiling a list of competent referral resources

- assess the nature and severity of the persons problem

- remind you that there are limits to a lay caregivers role

ESTABLISH A NETWORK OF FINANCIAL PROFESSIONALS

Financial stresses complicate the lives of many of the people who come for emotional, relational, and spiritual counseling. Often those who are struggling in marriage or raising teenagers argue about money. People who are depressed may have gone over the edge because of financial trouble or they may experience the strains of low income and debt because they are so depressed they cant work. Some people use spending like a drug, hoping the next new purchase will give them relief and a moment of happiness.

Many counselors avoid addressing financial issues because they dont feel competent in this areaand perhaps because they struggle with their own finances. The purpose of this book is not to urge you to become an expert in financial management, but instead, to provide insights to help you address this crucial issue when it arises in the lives of your clients.

In many (if not most) cases, your clients will need more help with financial matters than you can offer, so its important for you to find and vet a few financial professionals you can trust. Some specialize in helping people who are buried in debt, and others can help with mortgages, insurance, or legal matters. In your church and your community, look for insurance agents, financial planners, and attorneys who have a sterling reputation for compassion and excellence in their field. Creating this network takes time, but it will be a valuable resource for many of your clientsand when these professionals have clients with emotional problems, theyll probably refer them to you.

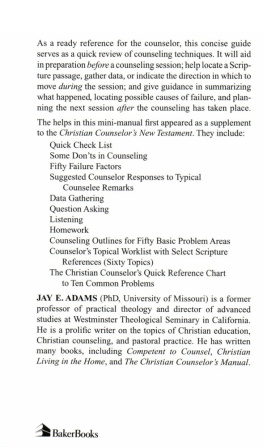

HOW TO USE THIS GUIDE

This Quick-Reference Guide provides insights and resources to help you assess problems and offer effective solutions. The elements in each section are:

- Portraits. The Portraits show how a specific issue (for example, setting goals, debt, budgeting, compulsive shopping) surfaces in individual lives and relationships. We provide several portraits for each topic because one issue can present itself in different ways in different individuals lives.

- Denitions and Key Thoughts. This section will help you understand the nuances of the problem and provide direction for your conversations with the person.

- Assessment Interview. For each topic this section provides important, probing questions you can use to assess the persons needs and situation.

Next page