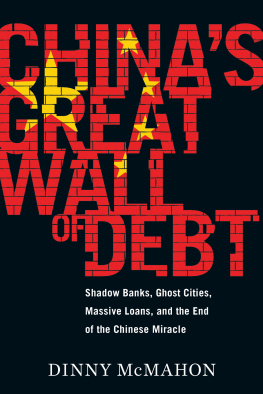

McMahon - Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle

Here you can read online McMahon - Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: China, year: 2018, publisher: Little, Brown Book Group, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

LITTLE, BROWN

First published in the United States in 2018 by Houghton Mifflin Harcourt

First published in Great Britain in 2018 by Little, Brown

Copyright 2018 by Dinny McMahon

The moral right of the author has been asserted.

All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, without the prior permission in writing of the publisher, nor be otherwise circulated in any form of binding or cover other than that in which it is published and without a similar condition including this condition being imposed on the subsequent purchaser.

A CIP catalogue record for this book is available from the British Library.

ISBN 978-1-4087-1033-3

Little, Brown

An imprint of

Little, Brown Book Group

Carmelite House

50 Victoria Embankment

London EC4Y 0DZ

An Hachette UK Company

www.hachette.co.uk

www.littlebrown.co.uk

To my mum and dad, for choosing Chinese

IN 1985, HU YAOBANG, the general secretary of the Chinese Communist Party and the second-most important man in China, after Deng Xiaoping, visited Australia. In an action that was somewhat unusual for a world leader, Hu didnt head straight for Canberra, the capital, or any of the major cities. He started his visit by flying into Paraburdoo.

Paraburdoo, or Para to the locals, is a small mining town just inside the southern edge of the Pilbara, a sprawling band of red earth that starts at the Indian Ocean and stretches deep into the Australian interior. The town is named for the indigenous word for the white cockatoos that throng the town or at least the cockatoos would be white were it not for the red dust that coats everything, birds included.

When the rains come at the beginning of each year, they turn Paraburdoo into a riot of color, with Ashburton and Sturt peas sprouting purple and pink along the side of the roads. But for most of the year, Para is a Mars-like red desert punctuated by scrub. Its also one of the hottest places in Australia, and home to swarms of flies a major concern for the advance team of Chinese officials who visited three weeks ahead of their boss.

What drew Hu to this remote, inaccessible corner of Australia was, in fact, the red dirt. Paraburdoo, and the Pilbara more generally, is one of the richest sources of iron ore anywhere in the world. Soon after consolidating power, in 1978, Deng Xiaoping launched a major program to modernize the Chinese economy after decades of stagnation under Mao Zedong. To do so required resources. Hu had flown into Paraburdoo to visit Mount Channar twenty kilometers down the road, an ore-rich hill that would become the first overseas-resources investment by the Chinese state. Standing atop the future mine site, Hu, speaking halting English, called the hill a treasure house.

I visited Paraburdoo with my father in 2011. Hed built the mine at Paraburdoo in 1971 to supply a Japanese economy that was in the throes of its postwar economic miracle, but my father hadnt been back in forty years. Superficially the town was much the same. The mine managers house and its manicured lawn, incongruous amid the red dirt, was still called the Mouse House, named for Mighty Mouse, the nickname Dad picked up for his diminutive stature and his drive to get the first shipment of ore delivered on time. Nearby the golf course was still nine holes of dirt with not a blade of grass to be seen. Even the putting greens were red, made from oiled sand that required careful sweeping before each putt.

What had changed, however, was the workforce. Forty years earlier, to work in Paraburdoo was to live there, which meant putting up with the heat, the distance, and the gender imbalance. But in 2011, that had changed. Instead of being permanent residents, about 20% of the predominantly male workforce were FIFOs, or fly-in, fly-outs. The company flew the workers in for two weeks of work, then flew them back out to civilization for a couple of weeks off. That change was necessary to find and keep workers.

During Dads time at Paraburdoo, it was the third mine in the Pilbara. Almost twenty years later, Channar was only the fifth. But by 2011, there were more than thirty mines in the Pilbara, most of which had been built since 2000. To staff that many sites in addition to the proliferation of mines elsewhere in the country companies had to find ways to make mining more appealing. That meant employing FIFOs and paying them among the best wages in Australia. Truck drivers and drill operators in the Pilbara region could earn as much as AUD $200,000 a year. Sydney and Melbourne were all but drained of tradespeople as skilled labor headed to the mines. In sum, these workers were servicing a boom without historical parallel Chinas boom.

A couple of decades ago, China was just the worlds factory, with little relevance to the rest of the globe beyond its ability to churn out cheap sneakers. Then, large-scale urbanization generated unprecedented demand for resources, breathing life into the Pilbara and creating a bonanza for commodity-exporting nations everywhere. Today, the Chinese economy is graduating to the next stage. A vibrant middle class is emerging, which promises to drive global growth for decades to come as potentially hundreds of millions of consumers develop tastes comparable to their counterparts in rich nations.

Meanwhile, thirty years after the Australian government took a leap of faith by allowing the Chinese Communist Party (CCP) to make one of its first overseas investments, today there is so much Chinese investment flowing abroad that capitals from Canberra to Washington, D.C., to Berlin fret over the security implications. Yet city mayors and state governors in those same countries aggressively court Chinese companies in the hope that their investment will help reinvigorate local communities. And in developing countries, Chinese loans have made possible the construction of infrastructure vital to economic development, such as much-needed ports and roads as well as less-needed sports stadiums and government offices that wouldnt get built without Chinas money.

For decades, the world has depended on the United States and Europe as twin engines of growth, a highly precarious state of affairs if both engines sputter at the same time, as was the case during the global financial crisis. With China forecast to overtake the United States as the worlds biggest economy around 2030, China is finally emerging as a third engine. Yet, as the world salivates at the prospect of Chinas economic ascendancy, its Chinas economic weakness that should have us all worried.

I had my first Chinese-language lesson in 1988, when I was nine years old, a few months after China finally signed the deal to develop the Channar mine. It was Dads idea, but it was my long-suffering mother who was responsible for getting me to go to those lessons after school every Friday afternoon. I repeatedly explained to her, in no uncertain terms, that she was wasting her time and money. Nevertheless, not only did she prevail but somehow I stuck with Chinese through primary school, and then through high school.

In hindsight, the 1990s were still the early days of Chinas boom. As late as 2003, Japan was still the main destination of Australian ironore exports, whereas today more than 80% go to China. Nonetheless, when I was at high school, there was something seemingly inevitable about Chinas ascent and something unambiguously good about it, too. I still recall preparing for my high school graduation exams, in 1996, and memorizing sentences that I could draw upon during the final tests: Learning Chinese will help me find a job; Chinas fast economic development is good for Australia.

Next pageFont size:

Interval:

Bookmark:

Similar books «Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle»

Look at similar books to Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Chinas great wall of debt: shadow banks, ghost cities, massive loans and the end of the Chinese miracle and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.