Contents

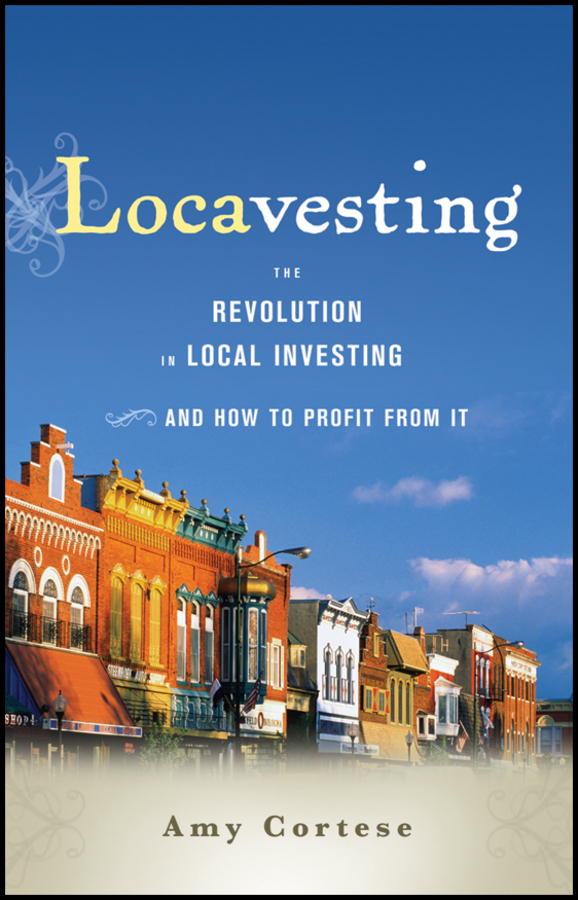

Copyright 2011 by Amy Cortese. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

Cortese, Amy, 1961

Locavesting : the revolution in local investing and how to profit from it / Amy Cortese.

p. cm.

Includes index.

ISBN 978-0-470-91138-9 (cloth); ISBN 978-1-118-08580-6 (ebk); ISBN 978-1-118-08579-0 (ebk); ISBN 978-1-118-08578-3 (ebk)

1. Small businessFinance. 2. Investments. 3. Community development. I. Title.

HD2341.C67 2011

332.6dc22

2011005647

For my Mother

Preface

Starting Anew

It was early September 2009, the first anniversary of the collapse of Lehman Brothers, which precipitated the worst economic downturn since the Great Depression. Fifteen million Americans were out of work and the economy was still shedding massive numbers of jobs each month. Millions of people owed more on their homes than they were worth and faced foreclosure. All over the country, small businessesthe engines of job creation and innovationwere starved for credit and growth capital.

Yet on Wall Street things were looking up. The S&P 500 was rebounding. After a $700 billion taxpayer-funded infusion and trillions more in emergency lending and guarantee programs, the nations biggest banks were doing swimmingly. The top four banks emerged with an even greater share of the pie, counting 60 percent of all bank deposits between them. Goldman Sachs had recently posted the largest quarterly profit in its 140-year history, largely fueled by proprietary trading gains in a volatile market. Bonuses were back to boom levels. Morgan Stanley set aside a whopping 62 percent of its revenue to lavish on employees.

That massive disconnect between Main Street and Wall Street was starkly clear as I flew to Santa Fe to attend the inaugural national gathering of Slow Money, a Slow Foodmeets-finance organization whose goal is to bring money back down to earth. Hundreds of social investors, entrepreneurs, farmers, and citizens had assembled to see if we couldnt somehow begin to create new models for investing in local, small-scale food and agriculture enterprisesthe kinds of enterprises that create things of value and help build healthy communities.

The moment was ripe with possibility. People everywhere were hungering for solutions. Although I didnt find any in Santa Fe, at least not fully formed and ready to go, the air was electric with ideas and energy. Local stock exchanges, new community-based funds, municipal bonds that would finance local food and agriculturethese were just some of the proposals being dreamed up to begin rebuilding our local economies and foodsheds. Slow Money chapters were springing up across the country, from Boston to Boulder.

As a journalist, I had covered many emerging trends that would go on to fundamentally reshape business and society: the rise of the Web, the green business and cleantech pioneers, and the growing shift toward a socially responsible way of doing business. There was something similarly significant afoot. As the country was casting about for solutions to pull us out of our economic morass, maybe the answer was right in our own backyards, in the small businesses that anchor our communities and economy.

What would the world be like if we invested 50 percent of our assets within 50 miles of where we live? Woody Tasch, the founder of Slow Money asked.

It was the most interesting question Id heard in a while.

This book is about alternatives.

Long before the global financial crisis exposed the flaws of our complex, intertwined, profit-at-any-cost system, a profound movement had been building that is centered on building resilient, sustainable, and healthy communities. It can be seen in the surge of buy local sentiment, farmers markets, and locavore diets.

Today, we are buying local and eating local, but we still arent investing local. There just hasnt been an easy way for individuals to put money into worthy small businesses in need of capital.

The truth is, our financial markets have evolved to serve big businesswhen they serve business at all, that is. Of all the trillions of dollars madly flying through the financial markets, less than 1 percent goes to productive use, in other words, to providing capital to companies that will use it to hire, expand, or develop new products. The rest is sucked into the voracious maw of trading and speculation. And that tiny fraction of productive investment goes mainly to companies big enough to issue shares in initial or secondary public stock offeringsan increasingly exclusive club. When small enterprises create three out of every four jobs and generate half of GDP, that is not an efficient allocation of capital.

At the same time, the traditional funding sources for small businessessavings, friends and family, venture capital, and bank credit and loanshave become mighty scarce since the financial crisis. Its more than a temporary freeze. Long-term trendssuch as accelerating consolidation in the banking industry and less risk taking among venture capitalists (VCs)do not bode well for the nations small businesses. And decades-old securities regulations make it difficult for average investors to put money into private firms. Indeed, its easier for most folks to invest in a corporation halfway around the world than in a small business in their own neighborhoods.