Publishers Preface, 1979

(Some very important notes)

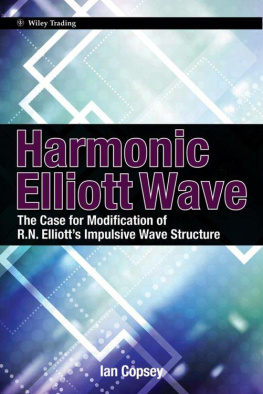

IN PUBLISHING THIS far-reaching book on the Elliott Wave Principle, material which has for too long laid undeservedly neglected, it is hoped that we will have helped in opening new vistas to the study of market timing. And further to this book, at the end of this Preface, we offer a way that some readers will want to pursue in looking for a deeper enlightenment in the unique approach of R.N. Elliott, and possibly other approaches, to the continuing analysis of the action in the trading marketplaces.

Having been associated with the Author for a number of years, we can attest to the high place he holds in our esteem in his knowledge and utilization of the Elliott Wave theory in actual investment practice. And especially in the light of the contents of this book, we feel that a few additional words about the Author will help in the enjoyment and understanding of this work. Following several years of active involvement in the investment field on Wall Street, leaving his native land he settled in London, England where he saw a great opportunity in the various fields of finance. Just a few years later he was instrumental in starting the prestigious Investors Bulletin, a weekly advisory service to British investors and institutions, in which he continues to apply his American market knowledge and training to analysing the movement of shares on the London Stock Exchange.

With an intimate knowledge of both New York and London markets and with both rich in their own historical movements, it was only natural that he would draw from both in presenting examples of Elliotts precepts. The major part of this work was originally written in 1976 by Mr. Beckman for his British audience where he is very well known from his daily radio broadcasts of market analysis and opinions. Naturally, some British references and examples were included for this audience, and in adapting the work for its American publication some were removed and others have been left as originally set forth since they certainly have something to add to their own knowledge of financial conditions in other parts of the world.

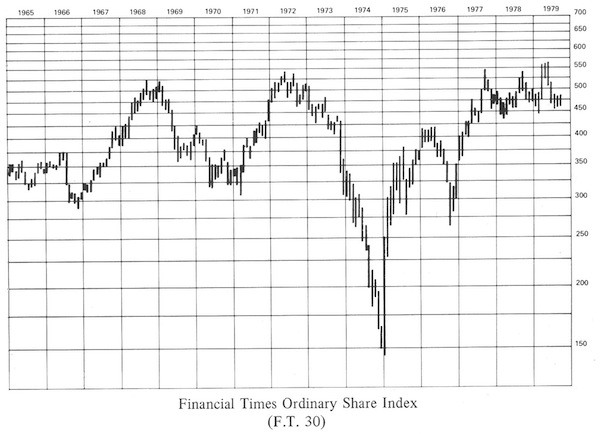

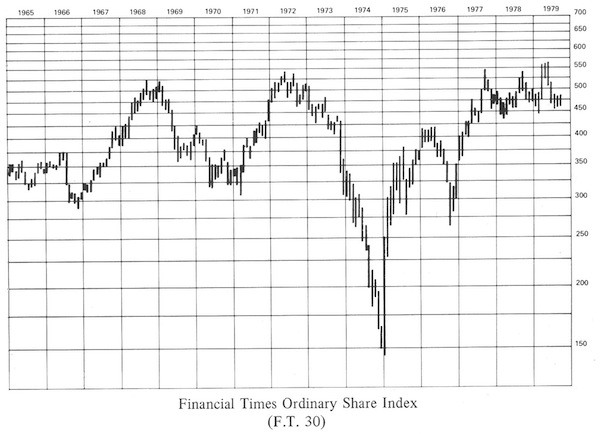

Taking the past 10 years as a single period, and comparing movements of the major stock exchanges around the world, the London market has undoubtedly been the most dynamic in its swings in plunging to extreme major lows and rising to all-time highs. This alone makes it a splendid market to use for good examples of Elliotts wave system, and for readers mainly familiar with only moves of the New York Stock Exchange and the Dow-Jones 30, the experience of seeing the detailed action of another very important market should prove equally rewarding.

From time to time Mr. Beckman also makes reference to some of the broad movements in London over this 10 year span of time and to help in following these references we have added the chart on the following page. This graph shows the monthly movement of the London F.T.30 Index, or to give its full and proper title the Financial Times Ordinary Share Index. This is the direct and comparable equivalent of our own Dow-Jones 30 Index. Turning to this particular chart when Mr. Beckman discusses some of the historical movements of this Index will give the reader the perspective to follow the points he makes.

To clear up a term that will be found to be unfamiliar when first seeing it, on the chart found on page 14, which shows the daily action of the F.T.30 over the stated period, the words Bargains total can be seen. In London this is the measurement of the daily volume, and it is actually the volume as measured by each reported dealing in each companys shares. One Bargain represents one trade whether it is for 10, 100 or 1,000, or whatever number of shares. Another fact that should be noted is that the F.T.30 is only compiled and reported once an hour and at the close of trading each day as compared to the D.J.30 where we have minute to minute reporting.

Throughout the text of this book can be found slight differences in the spelling of several words, and these reflect the small variations in the two usages of the English language in each country. As these differences are so few and so slight, we have left them as they were originally set out to avoid giving any added confusion to our typesetters. We doubt that they will prove of any bother to the reader.

Introduction

DURING AN ILLNESS in the mid-1930s, the late R.N. Elliott undertook the painstaking procedure of attempting to classify share price movements for the preceding 80 years on Wall Street. It was during the course of this work that Elliott discovered a definable basic rhythm in share price movements which he felt had forecasting value when correctly applied. In 1938 Elliott published his findings in a monograph entitled The Wave Principle. Eight years later, as a result of further discoveries, he updated the original work in another thesis entitled Natures Law. Since then, with the exception of a few notable analysts who have achieved outstanding success with Elliotts theory, the work has drifted into relative obscurity, both of these works being long out of print while the only practitioners of the Elliott Wave Principle are now in North America.

The Elliott Wave theory will probably never achieve the acclaim it deserves for many reasons. Firstly, it is somewhat of a hybrid theory. It belongs in the category of those tools which attempt to analyse the stock market on technical grounds yet is anathema to most chartists who only have confidence in trend chasing methods. In addition, the Elliott Wave principle makes no claim to predict the future, although far more startling results have been achieved with Elliott than with certain popular methods which do make such claims. Probably the most severe impediment to the popularity of the method is the initial apparent complexity and variations that must be recognised. The technical methods of dealing with share price movements that have gained popularity usually rely upon a mechanical approach which gives definite buy, sell or hold signals, the technique of which can be mastered in a few short hours. I warn you, this is not the case with the Wave Principle. Mastery of this technique will take a great deal of time and patience and judgement in its application. Furthermore, before one can apply the principle with sufficient confidence to make it a profitable experience, most conventional stock market theory will have to be placed in suspense in the recognition that the stock market offers no absolutes and there is no man alive who can predict with any useful, meaningful degree of accuracy where share prices will be one day hence, much less one year or more hence.