- CHAPTER ONE

On the NationalLevel - CHAPTER TWO

The Role of Banks - CHAPTER THREE

When to Spend andWhen to Save - CHAPTER FOUR

Factors That Affect YourFinancial Decisions - CHAPTER FIVE

On the State Level - CHAPTER SIX

How the EconomyAffects You

Published in 2013 by The Rosen Publishing Group, Inc.

29 East 21st Street, New York, NY 10010

Copyright 2013 by The Rosen Publishing Group, Inc.

First Edition

All rights reserved. No part of this book may be reproduced in any form without permission in writing from the publisher, except by a reviewer.

Library of Congress Cataloging-in-Publication Data

Strazzabosco, John.

How spending and saving affect you/John Strazzabosco. 1st ed.

p. cm.(Your economic future)

Includes bibliographical references and index.

ISBN 978-1-4488-8344-8 (library binding)

1. Saving and investmentUnited States. 2. Consumption (Economics)United States. I. Title.

HC110.S3.S83 2013 339.4'30973dc23

2012017552

Manufactured in the United States of America

Contents

CHAPTER ONE

On the NationalLevel

CHAPTER TWO

The Role of Banks

CHAPTER THREE

When to Spend andWhen to Save

CHAPTER FOUR

Factors That Affect YourFinancial Decisions

CHAPTER FIVE

On the State Level

CHAPTER SIX

How the EconomyAffects You

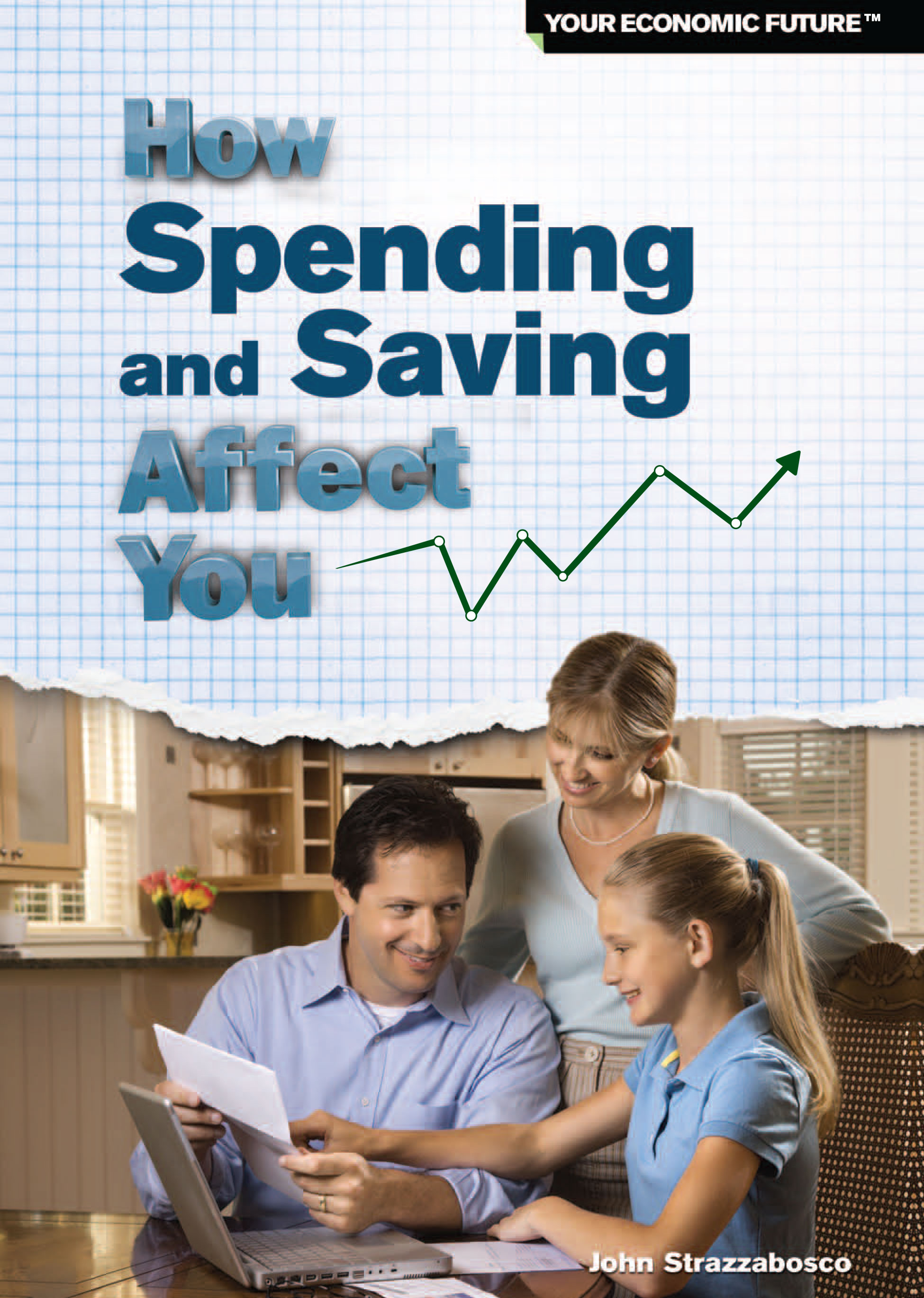

H ow we spend or save our money sometimes brings on a heated family discussion. One day you plead for a flat-screen television for the family, and the expressions brought to your parents faces suggest that is not going to happen.

When you ask why not, your father begins to talk about his retirement plan. From your fathers tone and body language, you get the idea that he would make the television purchase if he could. He doesnt like disappointing you. Thats clear. He explains that money that would go to a television would be much better used elsewhere. If he invests in his retirement plan at work, called a 401(k), he and your mom would be on track to retire when planned.

He elaborates on how a 401(k) works. Your dad is seizing the moment, giving you a lesson on how spending and saving affect you. Saving requires deferred gratification, putting off a purchase into the future. On the one hand, you badly want that television now. On the other hand, money put into a retirement account tends to grow over time. After many years, the money he would have spent on a television would have grown sizably.

This lesson makes you wonder. You recently received $20 for your birthday, and it suddenly occurs to you that you will soon be forced to make a similar choice: spend or save your $20? What would make you choose to save your $20 instead of spending it, or vice versa?

Y ou may not realize it, but the ways that countries around the world spend and save their money have a great impact on you. Each countrys way of spending and saving is important. Some countries are big spenders, and some are big savers.

All nations participate in the world economy, and each country impacts the others to a certain degree. This is part of what we call globalization. As author Greg Ip says in The Little Book of Economics, Globalization is exerting an often hidden influence, the way a distant planets gravitational pull alters another planets orbit. So one countrys economy might drag anothers up or down. Even when you follow good spending and saving practices, things can go wrong. But exactly how does it affect you?

Today, many of the products Americans consume are exported from China by sea and air, which keeps costs lower than if they were made in America.

A Tale of Two Countries

We start with a comparison of the worlds two major economic powers, which have very different ideas on how to run their economy: the United States and China. At the time of this writing, the United States is the most dominant economic power in the world. Spending is a big part of it. China is the second most dominant economic power in the world. Saving is a big part of the Chinese economy.

Economic success stories can result from radically different approaches. Well look now at how this spending and saving affect the relationship between the two superpow-ers...and ultimately you.

During the Iraq War, the United States required massive funding to finance its armed forces. Yet where would the money come from? One possible source was taxes. The decision was not to raise taxes on U.S. citizens. However, where else could America find funding for its military?

Raising Money with Bonds

The way one country invests in another is normally done through the sale of bonds. For example, if America needs money and China has the funds available, Chinese investors send those funds to America and America issues a bond, a financial instrument that serves as an I.O.U., or something borrowed. In this case, the bonds were issued by the U.S. Treasury.

U.S. Treasury bonds are often just called Treasuries. Treasuries not only pay interest each year from America to whoever holds the bonds, but they are also worth the purchase price paid for each bond. When the bondholder later cashes in those bonds, each investor gets his or her money back, plus the interest due.

Savings bonds allow governments to raise capital from its citizens. A form of I.O.U, bonds are sold to members of the public, who get back their money at a later date with interest.

However, a problem potentially arises. If China holds the bonds, and after a year the interest on the bond is due, what happens if America doesnt have the funds to pay off that interest? The owing partyin this case, Americais said to be in default. For a country, the bad reputation of becoming the defaulting party could hurt its ability to borrow money in the future, among other issues. A bad reputation might cause a whole countrys economic system to suffer.

Therefore, bond sales do come with risks. As author Ip says, though, The U.S. Treasury bond market is to the world... a safe place to store cash you need in a hurry. In other words, a country can depend on getting back its investment, plus interest, when buying U.S. Treasuries whenever it wants.

For that matter, you might also someday decide to invest in Treasuries or other government bonds, like U.S. savings bonds, if you wanted a safe place to keep your cash for a while and earn some interest.