How Can I Retire If I Am 62 and Broke?

by

Dale C. Maley

SMASHWORDS EDITION

* * * * *

PUBLISHED BY:

Artephius Publishing on Smashwords

How Can I Retire If I Am 62 and Broke?

Copyright 2011 by Dale C. Maley

All rights reserved. Withoutlimiting the rights under copyright reserved above, no part of thispublication may be reproduced, stored in or introduced into aretrieval system, or transmitted, in any form, or by any means(electronic, mechanical, photocopying, recording, or otherwise)without the prior written permission of both the copyright ownerand the above publisher of this book.

*****

Table of Contents

Historical Wealth Distribution

Alternatives

Working Longer

Reduce Expenses

Down-Size Your Home

Sell Home and Rent

Move to a Lower Cost State

Move to a Lower Cost Country

Exchange Your House for an RV

Share a House

Reverse Mortgages

Financial Planning Resources

Summary

* * * * *

Warning-Disclaimer

This book is designed to provide information inregard to the subject matter covered. It is sold with theunderstanding that the publisher and author are not engaged inrendering legal, accounting, insurance, or other professionalservices. If legal or other expert assistance isrequired, the services of a competent professional should besought.

It is not the purpose of this manual to reprintall the information that is otherwise available to the authorand/or publisher, but to complement, amplify, and supplement othertexts. You are urged to read all the available material, learn asmuch as possible about investing and to tailor the information toyour individual needs.

Every effort has been made to make this book ascomplete and as accurate as possible. However, there may bemistakes both typographical and in content. Therefore, this textshould be used only as a general guide and not as the ultimate ofinvesting information. Furthermore, this book contains informationon investing only up to the printing date.

The purpose of this book is to educate andentertain. The author and the publisher shall have neitherliability nor responsibility to any person or entity with respectto any loss or damage caused, or alleged to be caused, directly orindirectly by the information contained in this book.

* * * * *

Foreword

Most retirement books assume you have time tosave and accumulate money or you already have a significant networth. Most of the 67 million Baby Boomers who are approachingretirement age have run out of time to save andaccumulate more wealth. This short story explores the optionsavailable to people reaching retirement age who are broke. Afterreading this short story, you will be able to make your ownwell-informed decision on how to optimize your chances of beingable to retire.

* * * * *

Historical Wealth Distribution

Pareto

Vilfredo Pareto was an Italian engineer andeconomist who lived from 1848 until 1923. [1] In the late 1800s hestudied the distribution of income and wealth in Italy. He wassurprised to find that 20% of the population had 80% of the incomeor wealth. He then studied the country of England,and found the same result.

This is a unique phenomenon in that only 20%of the inputs control 80% of the outputs. This phenomenon has cometo be called the Pareto Rule or the 80:20 Rule.

If we roll the time clockforwards 100 years from Paretos Italian findings, we findthe same wealth distribution in America in 2011. [2] Approximately85% of the net worth in America is owned by only 20% of thepopulation.

Pensions and Social Security

In America, there have traditionally been twosources of retirement income for the 80% of the population that isnot wealthy. The first source has been traditional defined benefitretirement plans.

Unfortunately, traditional pension plans aregoing the way of the dodo bird. The invention of the 401K allowedcompanies to eliminate their long-term liability for retiredemployees. Very few traditional pension plans are still availableto active workers.

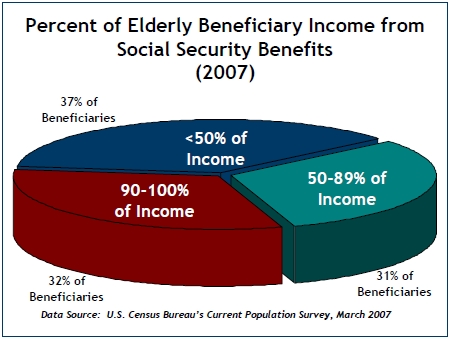

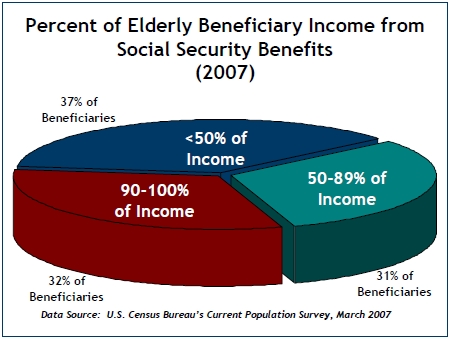

Social Security is the other major source ofincome for retirees.

As the pie chart above illustrates, SocialSecurity is the sole income source for 32% of the retirees. [3] 63%of families derive over half their retirement income from SocialSecurity.

All workers pay the same percentage of theirincome into the Social Security system regardless of income. Duringa working career, a high earner pays in many more dollars than arelatively low wage earner.

Social Security is designed to be a socialwealth transfer system. During retirement, lower paid workersreceive more Social Security income from the contributions ofhigher paid workers. The higher paid workers receive less SocialSecurity than is proportional to their higher contributions.[4]

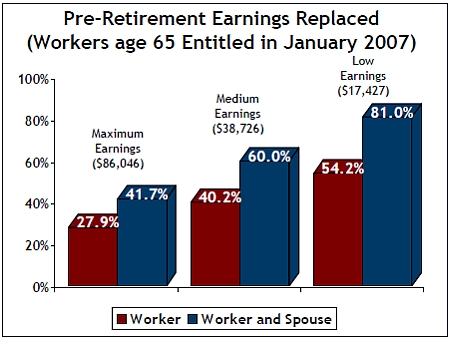

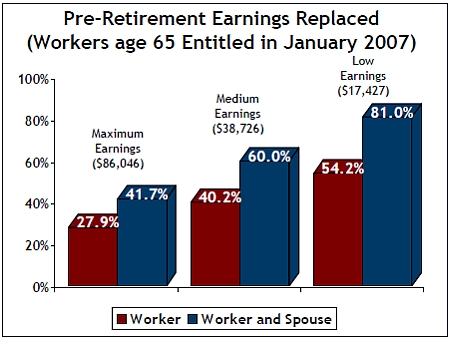

If you are a low earnings worker, SocialSecurity is designed to replace 81% of your working income (workerand spouse). If you are a high income worker, you only receive 42%of your working income (worker and spouse).

If you are a low earning retired couple, SocialSecurity gives you a large percentage of your pre-retirementincome.

If you are a high earning retired couple, SocialSecurity does not even give you half of your pre-retirement income.To maintain the same lifestyle in retirement, higher earningcouples must rely on pensions or investment income to make up thedifference.

Social Security is designed to be an actuariallyneutral system. This means the total dollars you receive duringyour retirement years will be the same regardless when you startingdrawing. If you start drawing Social Security at age 62, you willget less money each year. Over your expected life span you willreceive a certain lump sum.

If you wait until age 70 to start drawing SocialSecurity, you will get more money each year, but receive it overless total years. You will receive the same lump sum as if you hadstarting drawing at age 62.

The only way to beat the system is to livelonger than your life expectancy. If you live longer than expected,it makes sense to delay Social Security withdrawals until age70.

Each year you delay starting to withdraw fromSocial Security gives you an annual raise of about 8%. Starting towithdraw at age 70 gives you about a 64% pay raise over starting towithdraw at age 62. You can compare these options on your annualSocial Security statement.

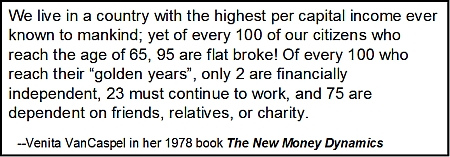

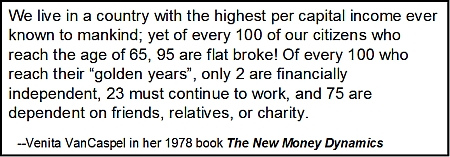

Astounding Statistics

Back in 1978, Venita VanCaspel wrote one of thefirst books about financial planning. [5] She cited some astoundingstatistics in this book.

Being 65 and flat broke is not a new problem.VanCaspels statistics are from 1978, thirty-three years ago!

*****

Alternatives

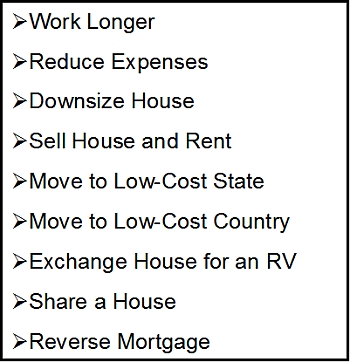

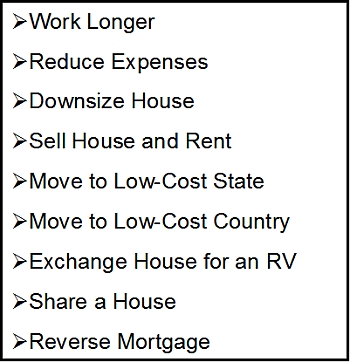

If you dont have enough income to retire, theconventional financial planning alternatives include:

There are at least two other options includingmoving in with your children and depending on charity. Since theseoptions are not attractive to most people, we will not explorethese two options.