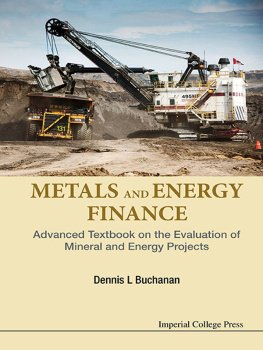

METALS AND ENERGY

FINANCE

Advanced Textbook on the Evaluation of

Mineral and Energy Projects

METALS AND ENERGY

FINANCE

Advanced Textbook on the Evaluation of

Mineral and Energy Projects

Dennis L Buchanan

Imperial College London, UK

Published by

Imperial College Press

57 Shelton Street

Covent Garden

London WC2H 9HE

Distributed by

World Scientific Publishing Co. Pte. Ltd.

5 Toh Tuck Link, Singapore 596224

USA office: 27 Warren Street, Suite 401-402, Hackensack, NJ 07601

UK office: 57 Shelton Street, Covent Garden, London WC2H 9HE

British Library Cataloguing-in-Publication Data

A catalogue record for this book is available from the British Library.

METALS AND ENERGY FINANCE

Advanced Textbook on the Evaluation of Mineral and Energy Projects

Copyright 2016 by Imperial College Press

All rights reserved. This book, or parts thereof, may not be reproduced in any form or by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval system now known or to be invented, without written permission from the Publisher.

For photocopying of material in this volume, please pay a copying fee through the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, USA. In this case permission to photocopy is not required from the publisher.

ISBN 978-1-78326-850-4

ISBN 978-1-78326-851-1 (pbk)

In-house Editors: Mary Simpson/Chandrima Maitra

Typeset by Stallion Press

Email:

Printed in Singapore

Contents

Acknowledgements

This book incorporates ideas that first evolved during the delivery of a range of professional development courses in London, Vancouver, Toronto, Stockholm and Johannesburg. The most relevant of the courses is probably Technical & Financial Evaluation of Mineral Projects (TechFin) that was launched in 1999 as a joint initiative with the Wits Business School Executive Education programme in Johannesburg and Imperial College Centre for Continuing Professional Development. The original TechFin course included basic concepts of discounted cash flow (DCF) analysis with an introduction to finance and accounting provided by Richard Anderson. Workshops were based around a set of custom DCF models for a range of different mineral projects. These had limited functionality and utility and were based on pre-funding scenarios.

An early version of IC-MinEval, a Visual Basic-based tool that automated the generation of financial models, developed with Dr Mark Heyhoe at Imperial College, provided the core intellectual property for an Imperial College start-up company. This was launched in 2000 and we called it IC-FinEval Ltd. I was the Chairman, Mark Heyhoe was Technical Director and Roger Haiat was our Commercial Director with Mervyn Jones joining the Board to represent Imperial College. The development of coal and petroleum fiscal modelling tools followed and functionality was undertaken with the support of Professor Tim Shaw and Colin Howard.

Core concepts outlined in this book arose from the collaboration I enjoyed with all these individuals while developing TechFin and IC-FinEval Ltd and I am most grateful to Mark, Roger and Mervyn for the generosity they displayed over the years in sharing their invaluable experience with me which helped to shape my ideas. Tim and Colin remain involved in the programme of joint teaching that we deliver and in the development of the concepts outlined in the book. I continue to value this ongoing professional and academic collaboration.

In 2012, IC-FinEval Ltd. was dissolved and the IP transferred to Imperial College but the functionality of IC-MinEval and IC-CoalEval remains available through InfoMine Inc. Simon Houlding, Vice-President of Professional Development for InfoMine and responsible for EduMine, the professional development division, provided outstanding support in this regard. He also supported the delivery of the IC-Mineval-based course Valuation of Mineral Projects in Vancouver and Toronto that was launched in 2006.

In 2006 I also launched the MSc Metals and Energy Finance degree as a joint Faculty of Engineering and Business School programme and the structure of this book is based on its teaching modules. Colleagues at Imperial College who have contributed to the delivery of the programme have generously permitted me to use some of their teaching material in preparing this book. Sources are given in figure captions when directly derived from their presentations and these included Professor Jan Cilliers, Professor Olivier Dubrule and Dr Stephen Neethling. Final text on petroleum systems was generated based on extensive discussions with Dr Mike Ala and Dr Peter Fitch during student field excursions along the Jurassic Coast for the MSc students. Dr Fivos Spathopoulos introduced me to the world of unconventional petroleum systems and Professor Mark Sephton reviewed the sections on organic chemistry. My thanks go to all of them for sharing their knowledge with me. I take full responsibility though for the views expressed in this book.

Thanks are due to the companies and organisations that granted me permission to reproduce images either obtained while I was on site at their operations or taken from their own image or photo galleries. These are identified in the Figure captions. Many of the insights described in this book arise from professional exchanges with hosts during site visits. I am also obliged to my son James who checked my thermodynamic and spreadsheet calculations and helped with the minerals engineering perspectives.

All the material in the book has been presented to the 2014/2015 cohort of postgraduate MSc Metals and Energy Finance students who proved to be the most discerning and attentive of recipients. I must acknowledge their active feedback which encouraged me to justify all contentions made and re-visit first principles in a way that would not have been possible had I been working in isolation.

Finally though this book could not have been written without the support and patience of my wife Vaughan and to her my grateful thanks. She acted as my own private copy editor. Her queries about confused sentences inevitably identified sections where there was underlying uncertainty in my own mind about the best approach to use in addressing the topic. Revising the sentence clarified the concept, at least in my own mind, but I hope also for the reader.

List of Abbreviations

| AIM | Alternative investment market |

| AMD | Acid mine drainage |

| ANFO | Ammonium nitrate and fuel oil |

| ATBI | After tax before interest |

| BIF | Banded iron formation |

| bpd | Barrels per day |

| BS | Black and Scholes |

| Capex | Capital costs |

| CAPM | Capital asset pricing model |

| CEng | Chartered engineer |

| CEO | Chief executive officer |

| CMMI | Council of Mining and Metallurgical Institutes |

| CRIRSCO | Committee for Mineral Reserves International Reporting Standards |