Turner - Between debt and the devil: money, credit and fixing global finance

Here you can read online Turner - Between debt and the devil: money, credit and fixing global finance full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: Princeton;Oxford, year: 2017;2015, publisher: Princeton University Press, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

Between debt and the devil: money, credit and fixing global finance: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Between debt and the devil: money, credit and fixing global finance" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Between debt and the devil: money, credit and fixing global finance — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Between debt and the devil: money, credit and fixing global finance" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

BETWEEN DEBT AND THE DEVIL

BETWEEN DEBT AND THE DEVIL

MONEY, CREDIT, AND FIXING GLOBAL FINANCE

ADAIR TURNER

PRINCETON UNIVERSITY PRESS

PRINCETON AND OXFORD

Copyright 2016 by Princeton University Press

Published by Princeton University Press, 41 William Street, Princeton, New Jersey 08540

In the United Kingdom: Princeton University Press, 6 Oxford Street,

Woodstock, Oxfordshire OX20 1TW

press.princeton.edu

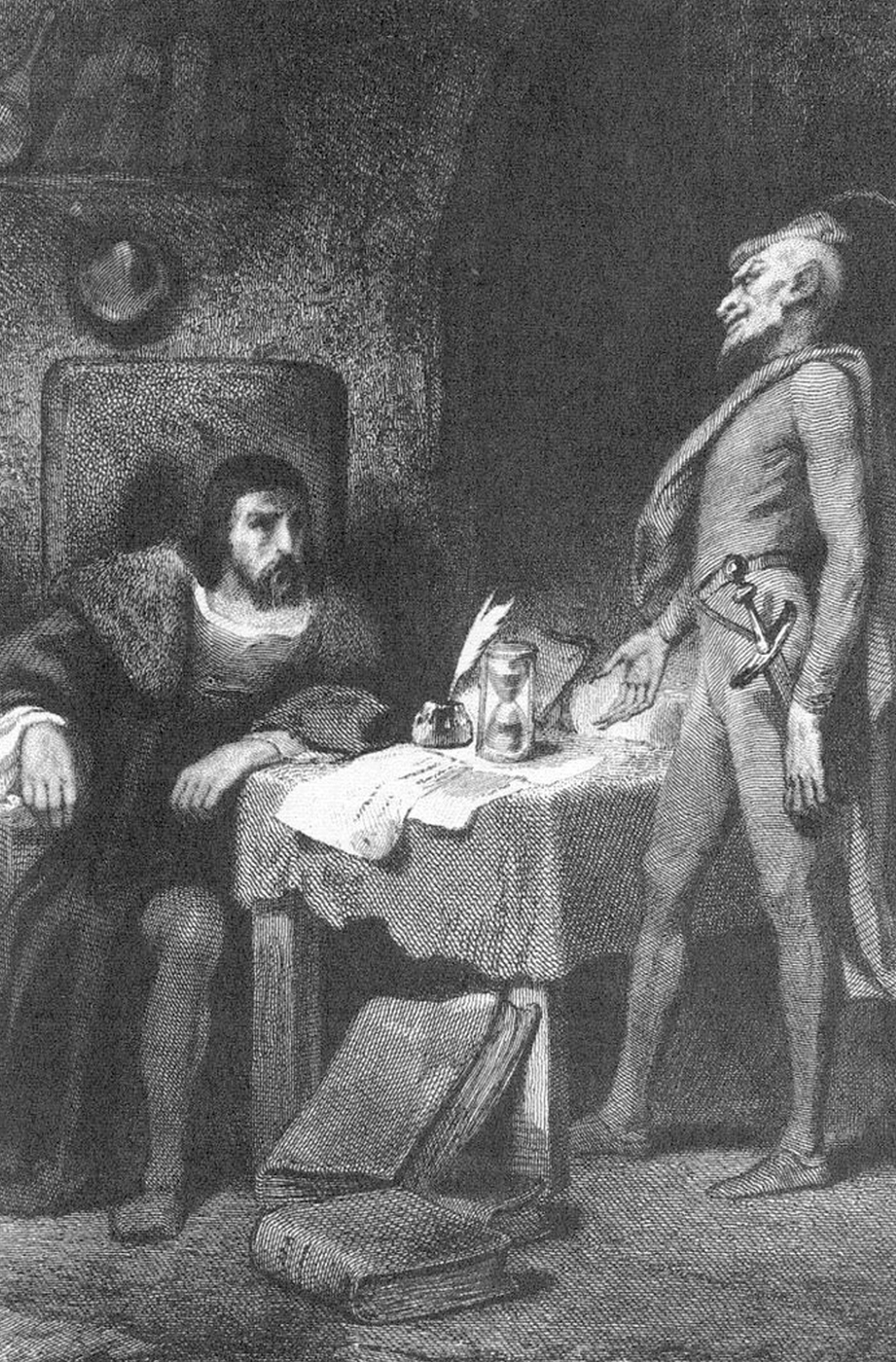

Jacket/frontispiece illustration: Faust and Mephisto, engraving by Tony Johannot, 18451847. From Johann Wolfgang von Goethe, Faust: Der Tragdie erster Teil, ed. Hans Henning, 1982.

All Rights Reserved

Library of Congress Cataloging-in-Publication Data

Turner, Adair, author.

Between debt and the devil : money, credit, and fixing global finance / Adair Turner.

pages cm

Includes bibliographical references and index.

ISBN 978-0-691-16964-4 (hardback) ISBN 0-691-16964-0 (hardcover) 1. International finance. 2. Finance. 3. Financial institutions. 4. Credit. 5. Financial crises. 6. Monetary policy. 7. Economic policy. I. Title.

HG3881.T88 2015

332.042dc23

2015015015

British Library Cataloging-in-Publication Data is available

This book has been composed in Minion Pro and Helvetica Neue

Printed on acid-free paper.

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

To Orna

CONTENTS

ACKNOWLEDGMENTS

T HERE ARE MANY PEOPLE without whom this book could not have been written, and my acknowledgements here are incomplete.

My first thanks must go to the Institute for New Economic Thinking (INET), which has supported me throughout the past 2 years, and to Robert Johnson, the executive director of INET, who has continually inspired me with the depth of his intellectual interests, encouraged me to think radically, and provided a never-ending stream of ideas for further research and reading.

In addition I must particularly thank two others. The first is George Soros, one of INETs founders, with whom I have discussed my emerging ideas since we first met in 2009, and whose own writing has posed a profound challenge to the simplicities of pre-crisis economic orthodoxy. The second is Martin Wolf. For several years Martin and I have been on a very similar intellectual journey, and his Financial Times columns and latest book, The Shifts and the Shocks, have played an important role in the development of my thinking.

My special thanks also go to friends who read and commented on early drafts of the book, including in particular Bill Janeway, Anatole Kaletsky, and Robert Skidelsky. And I am indebted also to Mervyn King, who, in the depths of the financial crisis of autumn 2008, first helped me understand the inherent instability of modern banking systems.

There are also many people with whom I have discussed my emerging ideas, or who have inspired me through their own writings. They include Anat Admati, Olivier Blanchard, Claudio Borio, Marcus Brunnermeier, Jaime Caruana, Ulf Dahlsten, Brad DeLong, Barry Eichengreen, Roman Frydman, Charles Goodhart, Andrew Haldane, Will Hutton, Otmar Issing, Oscar Jorda, Richard Koo, Paul Krugman, Michael Kumhof, Jean-Pierre Landau, Richard Layard, Paul McCulley, Atif Mian, Liu Mingkang, Rakesh Mohan, John Muellbauer, Avinash Persaud, Michael Pettis, Thomas Piketty, Adam Posen, Zoltan Pozsar, Enrico Perotti, Raghuram Rajan, Hlne Rey, Kenneth Rogoff, Moritz Schularick, Andrew Sheng, Joe Stiglitz, Larry Summers, Nassim Taleb, Gillian Tett, Jose Vinals, Paul Volcker, Richard Werner, and Bill White. Some of them will almost certainly disagree strongly with some of my arguments, but all have played a role in making me think.

I also thank many colleagues at the UK Financial Services Authority, and in particular Hector Sants and Andrew Bailey, who had to put up with my musings on fundamental causes and theory even as we were struggling with day-to-day crises, or who provided vital research input to analysis of these issues. And thanks also to the many members of the international Financial Stability Board with whom I worked closely for four years to redesign global financial regulation. There are far too many to mention them all, but in addition to Chairman Mark Carney, and Executive Director Svein Andresen (without whom we could never have made as much progress as we did), I pay particular tribute to fellow hawks in our debates, such as Philipp Hildebrand from Switzerland, Dan Tarullo and Sheila Bair from the United States, and my fellow Brit, Paul Tucker. We achieved a lot, even if I argue in this book that there is more to do.

I am also greatly indebted to my two research assistants, Lisa Windsteiger and Yuan Yang, who have helped me identify and analyze key arguments in the academic literature, have challenged my emerging ideas, and have been tenacious fact finders. My assistant Lina Morales has also played a vital role in the books production, working in particular on the bibliography.

No book can ever see the light of day without the hard work and encouragement of the publisher, and I am very grateful to Seth Ditchik at Princeton University Press for his excellent advice, which helped give the book a strong central focus, as well as to Cyd Westmoreland and Karen Fortgang for their vital role in editing and production. And my thanks also to my excellent agent, Georgina Capel.

Finally and most importantly my deepest thanks go to my wife Orna, who has lived with this book not for the year that I thought it would take to write, but for the two it actually required. Without her encouragement I would never have finished it. And without her unflagging support during five demanding years at the Financial Services Authority, I would never have been able to start it. This book is dedicated to her.

PREFACE

THE CRISIS I DIDNT SEE COMING

O N SATURDAY, SEPTEMBER 20, 2008, I became chairman of the UK Financial Services Authority. Lehman Brothers had failed the previous Monday; AIG had been rescued by the Federal Reserve on the Tuesday. Seventeen days later I was with Alistair Darling, UK finance minister, and Mervyn King, governor of the Bank of England, discussing with the major UK banks the need for public capital injections. The UK government ended up owning 85% of the Royal Bank of Scotland and 45% of Lloyds Bank Group. We faced the biggest financial crisis in 80 years. Seven days before I started, I had had no idea we were on the verge of disaster.

Nor did almost everyone in the central banks, regulators, or finance ministries, nor in financial markets or major economics departments. In April 2006, the International Monetary Fund (IMF) had described in detail how financial innovation had made the global financial system more stable. In summer 2007 the first signs of distress were seen as manageable liquidity problems. In summer 2008 most experts agreed that the point of maximum danger in this financial crisis had already passed. And even after the meltdown of autumn 2008, neither official commentators nor financial markets anticipated how deep and long lasting would be the post-crisis recession. Almost nobody foresaw that interest rates in major advanced economies would stay close to zero for at least 6 years. Almost no one predicted that the eurozone would suffer a severe crisis.

Next pageFont size:

Interval:

Bookmark:

Similar books «Between debt and the devil: money, credit and fixing global finance»

Look at similar books to Between debt and the devil: money, credit and fixing global finance. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Between debt and the devil: money, credit and fixing global finance and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.