Guide to

Ramit Sethis

I Will Teach You to Be Rich

by

Instaread

Please Note

This is a companion to the original book.

Copyright 2016 by Instaread. All rights reserved worldwide. No part of this publication may be reproduced or transmitted in any form without the prior written consent of the publisher.

Limit of Liability/Disclaimer of Warranty: The publisher and author make no representations or warranties with respect to the accuracy or completeness of these contents and disclaim all warranties such as warranties of fitness for a particular purpose. The author or publisher is not liable for any damages whatsoever. The fact that an individual or organization is referred to in this document as a citation or source of information does not imply that the author or publisher endorses the information that the individual or organization provided. This concise companion is unofficial and is not authorized, approved, licensed, or endorsed by the original books author or publisher.

Table of Contents

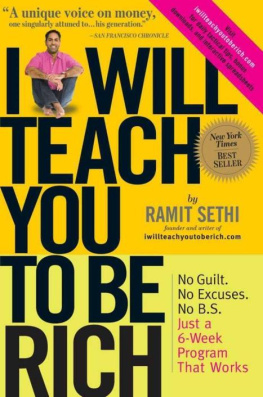

Overview

I Will Teach You to Be Rich is a do-it-yourself guide to building wealth over the course of ones lifetime with no quick fixes or special tricks. This 2009 New York Times bestseller provides helpful and sensible adviceparticularly aimed at millennialsto help anyone get out of debt, build their credit, and grow their net worth to reach whatever goals they have in mind for themselves and their future.

Structured as a six-week plan, I Will Teach You to Be Rich offers no get-rich-quick schemes or stock tips. Instead, the book focuses on long-term, personal finance strategies that build wealth over the course of decades, making the twenty-something reader a perfect target audience. The plan also urges its adherents to forego the small changes, like nixing the daily Starbucks latte, to set their sights on far bigger goals that they can achieve over the long term.

In week one, readers should focus on their credit history. In week two, readers should select a bank account with the highest possible annual rates of return. In week three, they should begin opening investment accounts, as investing will be the best possible way to ensure wealth growth over time. In week four, they should begin engaging in a conscious spending plan. Unlike a budget, this does not require accounting for every dime they spend. Instead, readers are advised to prioritize their spending on things that they love while cutting costs in areas they do not. In week five, readers should begin automating their accounts and the money that is allocated to investing. In week six, readers are ready to select the funds in which to invest. Mutual funds can pay out lavishly for a year or two but are to be avoided because, in the long term, they can be costly and risky. Index funds are a better option as they tend to keep pace with the markets over time. However, they can be more complicated and involve more research to select the right one. Lifecycle funds are the easiest and most convenient option. They insulate investors from market volatility over time by reallocating the funds to a more stable mixshifting toward a heavier inclusion of bondsas investors age toward retirement.

By following the simple steps contained within the book, people starting early enougheven those who lack any financial expertiseshould be able to protect and grow their future wealth and prosperity.

Important People

Ramit Sethi is the author of I Will Teach You to Be Rich, a New York Times bestseller. He is a graduate of Stanford University with a bachelors degree in Science, Technology, and Society and a masters degree in sociology. He runs online courses on personal finance and is an entrepreneur.

Key Insights

- Anyone can be rich.

- Set up your credit cards and improve your credit history.

- Open the right bank accounts to get higher interest. Negotiate accounts with no fees.

- Investing is the most effective way to grow your wealth.

- Determine the areas where you spend the most and where you want to target your spending. From there, youll be able to put your money toward the right goals for you.

- Automate your finances so that your investment accounts are all consistently seeded without you having to think about itor, more importantly, without allowing you to forget about them or rethink them.

- Avoid mutual funds. Invest in index funds or lifecycle funds instead.

- Dont try to make major money-management changes overnight.

Analysis

Key Insight 1

Anyone can be rich.

Analysis

Being rich isnt about reaching a specific net worth that will indicate to the world at large that youve made it. Instead, you must define what rich means to you. Does rich mean being able to take the job you love and not the job you need? Does rich mean owning a mansion in Malibu or just a small cottage on the Jersey Shore? Does rich mean that your kids graduate college debt-free thanks to mom and dad? Whatever it is, set the goal thats right for you and work towards it.

There is only one factor that is on your side when working toward your goal of becoming rich: time. The people that will fare the best will be those that start early. Over time, US markets will see great fluctuations, but overall, the trajectory has trended toward growth. [1] Whether or not there will be drops in the market is irrelevant over the long haul. Staying the course with passive investments is critical to future success. The people who have the most opportunities to grow their wealth are the youngest and, unfortunately, the people who are least likely to invest their money. A recent study found that only 26 percent of millennials had any stock-based or fund-based investments. [2]

Many millennials and other young people fail to invest, citing fear following the recent market crash. [3] The most commonly cited reason, though, for millennials failing to invest was that they felt they lacked the knowledge to do so. However, expertise is overrated; most investors do not need an expert. In fact, most would-be investors overcomplicate the process of investing and fail to jump in at all. With a simple plan, any individual can invest and even see better financial outcomes than they would with a financial adviser on retainer. Financial experts, in fact, have proven to be incapable of surpassing the market most of the timeand all will charge you to do so with your money. With a do-it-yourself solution, an amateur can beat these numbers without paying money to anyone.

Key Insight 2

Set up your credit cards and improve your credit history.

Analysis

Having a strong credit score is vital to growing wealth because people with good credit save money on long-term purchases by enjoying lower interest charges. Your credit is made up of your credit report and credit score. Your credit report includes the fundamentals of your accounts and whether youve paid on time or not, while your credit score is a number that represents how risky you might be to potential lenders. To present yourself to lenders as a less risky investment, credit cards can be an important tool for enhancing your creditas long as you never pay late and dont build new debt with them. If you struggle with remembering when to pay, automate your payments to save you from this danger. Always keep your cards for a long time and request higher credit limits periodically if you are without debt.

Credit cards can either be a very favorable tool in growing your credit, or they can be your downfall. As of 2015, the average American household was carrying $15,762 in credit card debta number that rises steadily every year. Nationwide, that equates to $733 billion. Whats more, that number does not include all of the other forms of debt that the American household carries: mortgages, student loans, and car loans that total to another $115,160or $12.2 trillion nationwide. [4]

Next page