I WILL TEACH YOU TO BE RICH

BY RAMIT SETHI

Workman Publishing, New York

Additional Praise for Ramit Sethi and I Will Teach You to Be Rich

Ramit Sethi is a rising star in the world of personal finance writing... one singularly attuned to the sensibilities of his generation.... His style is part frat boy and part Silicon Valley geek, with a little bit of San Francisco hipster thrown in.

SAN FRANCISCO CHRONICLE

The easiest way to get rich is to inherit. This is the second best wayknowledge and some discipline. If youre bold enough to do the right thing, Ramit will show you how. Highly recommended.

SETH GODIN, AUTHOR OF TRIBES

Youve probably never bought a book on personal finance, but this one could be the best $13.95 you ever spent. Itll pay for itself by the end of to see what I mean).

PENELOPE TRUNK, AUTHOR OF BRAZEN CAREERIST:

THE NEW RULES FOR SUCCESS

Most students never learn the basics of money management and get caught up in the white noise and hype generated by the personal-finance media. Ramits like the guy you wish you knew in college who would sit down with you over a beer and fill you in on what you really need to know about moneyno sales pitch, just good advice.

CHRISTOPHER STEVENSON, CREDIT UNION EXECUTIVES SOCIETY

Smart, bold, and practical. I Will Teach You to Be Rich is packed with tips that actually work. This is a great guide to money management for twentysomethingsand everybody else.

J.D. ROTH, EDITOR, GETRICHSLOWLY.ORG

Ramit demystifies complex concepts with wit and an expert understanding of finances. Not only is this book informative, its fun and includes fresh tips that will help anyone master their finances.

GEORGE HOFHEIMER, CHIEF RESEARCH OFFICER,

FILENE RESEARCH INSTITUTE

INTRODUCTION

WOULD YOU RATHER BE SEXY OR RICH?

Ive always wondered why so many people get fat after college. Im not talking about people with medical disorders, but regular people who were slim in college and vowed that they would never, ever get fat. Five years later, they look like the Stay Puft Marshmallow Man after a Thanksgiving feast, featuring a blue whale for dessert.

Weight gain doesnt happen overnight. If it did, it would be easy for us to see it comingand to take steps to avoid it. Ounce by ounce, it creeps up on us as were driving to work and then sitting behind a computer for eight to ten hours a day. It happens when we move into the real world from a college campus populated by bicyclists, runners, and varsity athletes who once inspired us to keep fit (or guilted us into it). When we did the walk of shame back at school, at least we were getting exercise. But try talking about post-college weight loss with your friends and see if they ever say one of these things:

Avoid carbs!

Dont eat before you go to bed, because fat doesnt burn efficiently when youre sleeping.

If you eat mostly protein, you can lose lots of weight quickly.

Eating grapefruit in the morning speeds up your metabolism.

I always laugh when I hear these things. Maybe theyre correct, or maybe theyre not, but thats not really the point.

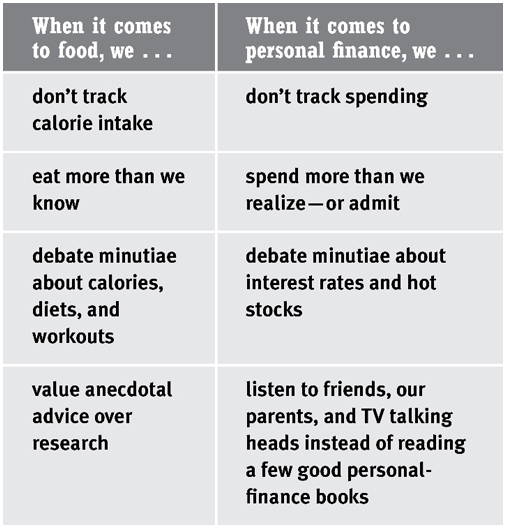

The point is that we love to debate minutiae.

When it comes to weight loss, 99.99 percent of us need to know only two things: Eat less and exercise more. Only elite athletes need to do more. But instead of accepting these simple truths and acting on them, we discuss trans fats, diet pills, and Atkins versus South Beach.

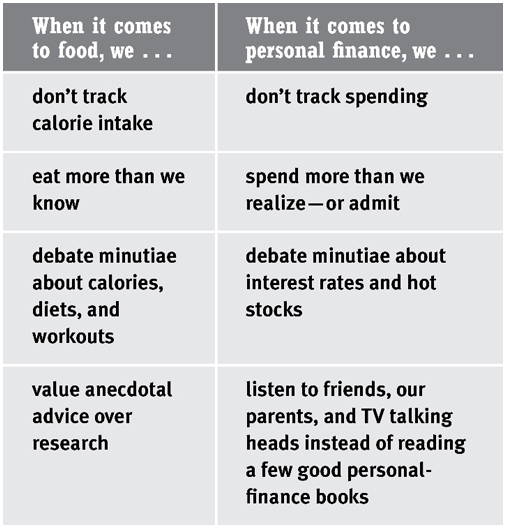

WHY ARE MONEY AND FOOD SO SIMILAR?

To review these figure in its PDF format, please visit this webpage:

www.iwillteachyoutoberich.com/kit

Most of us fall into one of two camps as regards our money: We either ignore it and feel guilty, or we obsess over financial details by arguing interest rates and geopolitical risks without taking action. Both options yield the same resultsnone. The truth is that the vast majority of young people dont need a financial adviser to help them get rich. We need to set up accounts at a reliable no-fee bank and then automate savings and bill payment. We need to know about a few things to invest in, and then we need to let our money grow for thirty years. But thats not sexy, is it? Instead, we watch shows with talking heads who make endless predictions about the economy and this years hottest stock without ever being held accountable for their picks (which are wrong more than 50 percent of the time). Sometimes they throw chairs, which drives up ratings but not much else. And we look to these so-called experts more than ever in turbulent times like the global crisis of 2008. Its going up! No, down. As long as there is something being said, were drawn to it.

Why? Because we love to debate minutiae.

When we do, we somehow feel satisfied. We might just be spinning our wheels and failing to change anyones mind, but we feel as if we are really expressing ourselves, and its a good feeling. We feel like were getting somewhere. The problem is that this feeling is totally illusory. Focusing on these details is the easiest way to get nothing done. Imagine the last time you and your friend talked about finances or fitness. Did you go for a run afterward? Did you send money to your savings account? Of course not.

People love to argue minor points, partially because they feel it absolves them from actually having to do anything. You know what? Let the fools debate the details. I decided to learn about money by taking small steps to manage my own spending. Just as you dont have to be a certified nutritionist to lose weight or an automotive engineer to drive a car, you dont have to know everything about personal finance to be rich. Ill repeat myself: You dont have to be an expert to get rich. You do have to know how to cut through all the information and get startedwhich, incidentally, also helps reduce the guilt.

Although I knew that opening an investment account would be a smart financial move, I set up a lot of barriers for myself. Joey, I said, you dont know the difference between a Roth IRA and a traditional IRA. Theres probably a lot of paperwork involved in getting one of those started anyway, and once its set up, its going to be a pain to manage. What if you choose the wrong funds? You already have a savings account; whats wrong with just having that? Clearly this was the voice of my lazy half trying to talk my body into staying on the couch and not taking action.

JOEY SCHOBLASKA, 22

Who wins at the end of the day? The self-satisfied people who heatedly debate some obscure details? Or the people who sidestep the entire debate and get started?

Why Is Managing Money So Hard?

People have lots and lots of reasons for not managing their money, some of them valid but most of them poorly veiled excuses for laziness. Yeah, Im talking to you. Lets look at a few:

INFO GLUT

The idea thatgasp!there is too much information is a real and valid concern. But Ramit, you might say, that flies in the face of all American culture! We need more information so we can make better decisions! People on TV say this all the time, so it must be true! Huzzah! Sorry, nope. Look at the actual data and youll see that an abundance of information can lead to decision paralysis, a fancy way of saying that with too much information, we do nothing. Barry Schwartz writes about this in