Copyright 2017 by Michael Pellegrino

All rights reserved. No part of this book may be reproduced in any manner without the express written consent of the publisher, except in the case of brief excerpts in critical reviews or articles. All inquiries should be addressed to Skyhorse Publishing, 307 West 36th Street, 11th Floor, New York, NY 10018.

Skyhorse Publishing books may be purchased in bulk at special discounts for sales promotion, corporate gifts, fund-raising, or educational purposes. Special editions can also be created to specifications. For details, contact the Special Sales Department, Skyhorse Publishing, 307 West 36th Street, 11th Floor, New York, NY 10018 or .

Skyhorse and Skyhorse Publishing are registered trademarks of Skyhorse Publishing, Inc., a Delaware corporation.

Visit our website at www.skyhorsepublishing.com.

10 9 8 7 6 5 4 3 2 1

Library of Congress Cataloging-in-Publication Data is available on file.

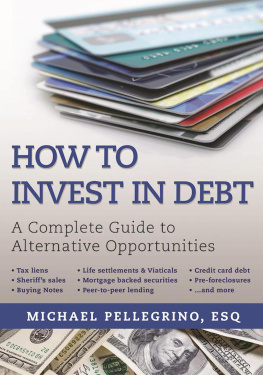

Cover design by Rain Saukas

Cover photo credit: iStock Photo

Print ISBN: 978-1-5107-1519-6

Ebook ISBN: 978-1-5107-1521-9

Printed in Canada

Disclaimer

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the publisher nor the author are herein engaged in rendering legal, accounting, financial, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a declaration of principles jointly adopted by a committee of the American Bar Association and a committee of publishers.

Dedication & Acknowledgment

This book is dedicated to my parents, Gerald and Maureen, who taught me to read and write and who paid for my education. I also thank my wife, Jennifer, and our children for patiently listening to me ramble on and on about investment concepts all the time.

Much thanks goes to my daughter, Jessica, who helped me to draft some of the more complex concepts.

Contents

Introduction

Debt Is RampantLets Make Money

O ur Debtor Nation is facing a real problem with excessive debt. As of the end of 2016, the official debt of the United States government was $19.3 trillion, which breaks down as:

$59,508 for every person living in the United States

$154,407 for every household

106 percent of the US gross domestic product

553 percent of annual federal revenues.

It took decades to get ourselves into this situation, which will not go away any time soon. I have yet to hear of any politician with a concrete plan to address the debt crisis. Most wont even mention it. There is nothing that we can do as individuals to solve this problem, so, as private investors, we seek ways to profit from this situation. This book will introduce you to ten opportunities to invest in debt. These investments are not widely known or promoted. They are often purchased at deep discounts, and the debt is often secured by valuable real property. Our leaders in Washington, DC, have loaded us down with lemons, so lets learn how to make a profitable lemonade stand.

Through my twenty-five-year law practice, I have represented a variety of large and small investors who have profited from investing in various forms of debt. I have learned the advantages and disadvantages of each option, and I distilled a guide for ten ways to invest in debt, either directly or indirectly. These investment vehicles are unusual. They can provide a valuable hedge against stocks and bonds, which move with the economy. These alternative debt investments often perform better when the economy is strugglingcontra other investments.

Most people have not even heard of these opportunities. There are very few books on these subjects, and they are not typically discussed on televised investment programs.

Tax Liens

Peer-to-Peer Loans through internet sites

Defaulted Credit Card Debt at a Discount

Defaulted Mortgage Notes

Performing Mortgage Notes at a Discount

Sheriffs Sales

White Knight Rescues of Preforeclosure Properties

Buying Foreclosed Properties

Life Settlements & Viaticals

Mortgage-Backed Securities

Each chapter in this book will introduce you to a different way to invest in debt. Ill explain how each investment vehicle works and tell you everything you need to know to participate in these opportunities. This book is not intended to promote these investments. Im not selling any consulting services or webinars. I will lay out both the good and bad aspects of each concept and leave it up to you to decide which are for you.

Is This Stuff For You?

Some of these investment opportunities are not for everyone. They work well for a certain type of person with an entrepreneurial spirit, a stomach for risk, and a high level of self-motivation. In my experience, the most successful investors in these vehicles have run their own small business or have experience investing in real estate. Others may very well succeed with no real estate or small-business experience, but be honest with yourself. If you have always been a nine-to-five employee, and never got around to investing in real estate or even picking your own stocks, then the more complex investments may not be the place to start. Dont worry, we will also cover a few debt investments that dont require any specialized knowledge or work at all, such as peer-to-peer lending, mortgage-backed securities, and life settlements. There is something for everyone.

This book does not promote any miracle investments or easy money. Some of the investment opportunities discussed are more like small businesses themselves than simple investments. In order to generate returns that are higher than average, an investor must find a way to gain separation from other investors. To beat the general market, an investor must gain an advantage over other investors and over the market itself by adding one or more these factors:

Luck

Luck

Risk

Risk

Work

Work

Specialized knowledge or ability

Specialized knowledge or ability

Anyone can get lucky and pick a winning stock once in a while, but luck is not consistent, and you cant do anything to improve or manage your luck. In order to obtain consistent higher returns, investors gain an advantage through hard work and by developing an advanced knowledge and ability to manage risk. For example, anyone can hit a lucky basketball or golf shot once in a while, but if you want to consistently win at basketball or golf, you cant rely on lucky shots. This common-sense rule applies to investing as well, so if you want to consistently win financially, then you must put in the work and gain a specialized knowledge and skill that most others dont have. Learn to recognize opportunities that others dont see.

Risk and reward go hand in hand. Investments with high potential rewards always carry higher risks. You must be willing to take risks and also be capable of assessing and managing those risks.

But dont worry , there is a book that guides you through these markets and you are already reading it! If you are with me so far, then you have what it takes to succeed. Keep reading for the information and skills that you need to set yourself apart, manage the inherent risks, and succeed with these investments.

Luck

Luck