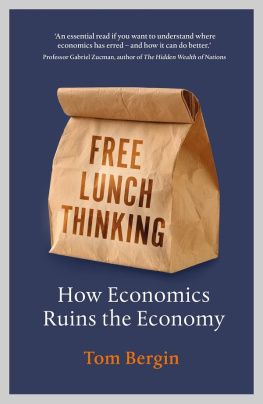

David Smith - Free Lunch: Easily Digestible Economics

Here you can read online David Smith - Free Lunch: Easily Digestible Economics full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2009, publisher: Profile Books, genre: Science. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Free Lunch: Easily Digestible Economics

- Author:

- Publisher:Profile Books

- Genre:

- Year:2009

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Free Lunch: Easily Digestible Economics: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Free Lunch: Easily Digestible Economics" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Free Lunch: Easily Digestible Economics — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Free Lunch: Easily Digestible Economics" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

FREE LUNCH

DAVID SMITH has been the Economics Editor of the Sunday Times since 1989. He also writes monthly columns for Professional Investor , British Industry and The Manufacturer , and is a regular contributor to the CBIs Business Voice and other publications. Prior to joining the Sunday Times , Smith worked for The Times, Financial Weekly , the Henley Centre for Forecasting and Lloyds Bank. He is the author of several books, most recently The Dragon and the Elephant , also published by Profile.

FREE LUNCH

EASILY DIGESTIBLE ECONOMICS,

SERVED ON A PLATE

David Smith

This edition updated in 2008

First published in 2003 by

Profile Books Ltd

3A Exmouth House

Pine Street

Exmouth Market

London ECIR 0JH

www.profilebooks.com

Copyright David Smith 2003, 2008

10 9 8 7 6 5 4 3 2 1

Typeset in Bembo by

MacGuru Ltd

info@macguru.org.uk

Printed and bound in Great Britain by

Bookmarque Ltd, Croydon, Surrey

The moral right of the author has been asserted.

All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the publisher of this book.

A CIP catalogue record for this book is available from the British Library.

eISBN: 978-1-84765-139-6

For Jane, Elizabeth, Emily, Richard and Thomas

Contents

Economics everywhere

When, in July 2007, two hedge funds run by the Wall Street investment bank Bear Stearns ran into difficulty, few could have guessed at the scale of the dramatic events that would follow. The funds, which had been worth $1.5 billion at the beginning of the year, were invested in financial products linked to what quickly became the notorious American subprime market. Sub-prime loans, to US households with impaired credit histories (the joke was that they were Ninja borrowers, with no income, no job and no assets) had been around for many years. They however, along with adjustable rate mortgages (Arms), had expanded very rapidly from around 2003 and, more significantly, had been used as the basis for financial instruments structured investment vehicles sold to investors and traded between the banks. Mortgage-backed securities, as their name suggests, are financial instruments based on household mortgages. Even more sophisticated instruments, so-called credit derivatives based on those securities, sliced and diced the original securities up even further and greatly multiplied the potential losses if there were problems with the underlying asset, the mortgage. The upshot was that if enough poor American families in Cleveland, Detroit or Fort Myers fell behind with their payments or defaulted on their mortgages the consequences would be felt by investors and banks many thousands of miles away. Think of it as an inverted pyramid resting on the unstable foundations of risky mortgages.

The Bear Stearns hedge funds were, to risk mixing metaphors, the tip of a very large iceberg, an early warning of the problems that were to follow. Even in early August 2007 after American Home Mortgage had filed for bankruptcy, most experts dismissed talk of a global financial crisis and it seemed that the problems arising from Americas subprime problems would be limited. However, it became clear that an international crisis was brewing when on 9 August the French bank BNP Paribas suspended three of its investment funds because of losses related to the US subprime market. An alarmed European Central Bank responded by pumping tens of billions of euros into Europes money markets.

What followed was a kind of domino effect, with banks regarded as weak or excessively dependent on wholesale money markets rather than savers deposits most heavily exposed. On 13 September, 2007 it was revealed that Northern Rock, Britains fifth largest mortgage lender, was being supported by lender of last resort assistance from the Bank of England. The following day saw the first run on a British bank since Overend & Gurney in 1866. (Northern Rock was eventually nationalised by Britains Labour government, after a five-month attempt to find a viable private-sector buyer.)

After the excitement of August and September, when money markets froze from a lack of confidence between the banks in each other, there were hopes that the worst might be over. It was, however, a vain hope. In March 2008, after months in which Wall Street investment banks and Americas other large banks had announced ever-larger write-downs and losses on their subprime-related investments, Bear Stearns was forced to sell itself at a knockdown price to competitor J. P. Morgan. The deal was only possible because it was accompanied by a $30 billion loan from the Federal Reserve, Americas central bank. Bear Stearns, founded in 1923, had been part of Wall Streets aristocracy, surviving the infamous crash of 1929 but now unable to weather the credit crunch of 20078. Indeed, the problems at its hedge funds eight months earlier had first exposed the crunch; now it was a victim of it. Soon afterwards, the International Monetary Fund said that the world was facing the biggest financial shock since the Great Depression of the 1930s.

Economic history in the making

Comparisons with the Great Depression and the bank runs of the Victorian era provided confirmation that something highly unusual was happening in the global economy. Indeed, policymakers looked to Walter Bagehot, the nineteenth-century economist, social theorist and constitutional reformer, who was editor of The Economist during the run on Overend & Gurney in the 1860s. Apart from computer technology, the global nature of the crisis and the fact that every move was played out on twenty-four-hour television, very little appeared to have changed since Bagehots day. Every great crisis reveals the excessive speculations of many houses which no one before suspected, he wrote in Lombard Street: A Description of the Money Market , published in 1873. And, the good times too of high price almost always engender much fraud. There is a happy opportunity for ingenious mendacity. Almost everything will be believed for a little while, and long before discovery the worst and most adroit deceivers are geographically and legally beyond the reach of punishment. Bagehot also understood what engendered financial panics: Any notion that money is not to be had, or that it may not be had at any price, only raises alarm to panic and enhances panic to madness. As for the way such panics could envelop even those regarding themselves as too good, or too big to fail he comments: A panic grows by what it feeds on; if it devours these second-class men shall we, the first-class, be safe?

People turned to history for the answers because the events of 20078 were so unusual in the modern era. What, for example, was a credit crunch? Defined as a sudden reduction in the availability of credit and an increase in its price, this was a modern-day rarity. Recent history is littered with examples of governments or central banks deliberately restricting the flow of credit to the economy and increasing interest rates. For such a phenomenon to occur naturally as a result of a sudden collapse of confidence in the banking and financial system was, however, different. It resulted, for example, in a 70 percent downward slide over twelve months in mortgage approvals the number of new loans being granted in Britain. The consequence of that extreme mortgage rationing was a dramatic drop in house prices. The discussion of Britains housing market and the debate over prices in Chapter Two of this book does not, you will see, even consider this possibility. While interest rates can and do rise and fall, the idea of a sudden turning off of the credit taps did not come into the debate. This was, if not uncharted territory, outside the direct experience of policymakers. The ready availability of credit had almost come to be regarded as the economic equivalent of oxygen or running water.

Font size:

Interval:

Bookmark:

Similar books «Free Lunch: Easily Digestible Economics»

Look at similar books to Free Lunch: Easily Digestible Economics. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Free Lunch: Easily Digestible Economics and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.

![David Orrell [David Orrell] - Quantum Economics](/uploads/posts/book/114631/thumbs/david-orrell-david-orrell-quantum-economics.jpg)